Trade Smarter, Not Harder: Unleash the Power of Algo Trading

in a few minutes

High Frequency Trading

High Volume Buy & Sell

Eliminating human error

Execution of multiple strategies

Features of Algo Trading

Simplify your trading journey with intuitive tools and expert support at your fingertips!

Speed & Efficiency

Algorithms can execute trades at speeds and frequencies far beyond human capability, taking advantage of even the smallest price discrepancies.

Scalability

Algo trading systems can handle large volumes of trades efficiently without requiring a proportional increase in resources.

Emotionless decision-making

Algorithmic trading takes emotions and psychological factors out of decision-making in trading, potentially leading to a more disciplined approach.

Reduced Human Error

By automating trade execution based on pre-defined rules, algo trading reduces the potential for human error in placing orders or managing positions.

Features of Algo Trading

Simplify your trading journey with intuitive tools and expert support at your fingertips!

Speed & Efficiency

Algorithms can execute trades at speeds and frequencies far beyond human capability, taking advantage of even the smallest price discrepancies.

Tailored Strategies

Traders can develop custom algorithms tailored to specific trading strategies, risk appetites and market conditions.

Scalability

Algo trading systems can handle large volumes of trades efficiently without requiring a proportional increase in resources.

Emotionless decision-making

Algorithmic trading takes emotions and psychological factors out of decision-making in trading, potentially leading to a more disciplined approach.

Reduced Human Error

By automating trade execution based on pre-defined rules, algo trading reduces the potential for human error in placing orders or managing positions.

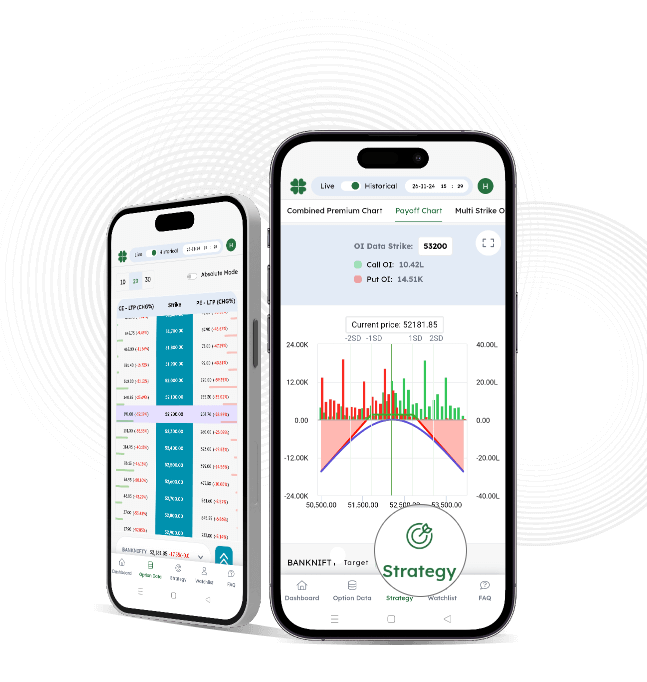

Comparison Between Algo & Manual Trading Algo Trading V/s Manual Trading

Large Trade, Less Time

Scalable

No Human Errors

Emotion Less / Disciplined

Automation

Low Impact Cost

Large Trade, Takes Time

Limited Stocks Scan

Chances of Human Errors

Gut Feeling Involve

Manual

High Impact Cost

Comparison Between

Algo & Manual Trading

Algo Trading V/s Manual Trading

Large Trade, Less Time

Large Trade, Takes Time

Scalable

Limited Stocks Scan

No Human Errors

Chances of Human Errors

Emotion Less / Disciplined

Gut Feeling Involve

Automation

Manual

Low Impact Cost

High Impact Cost

Large Trade, Less Time

Scalable

No Human Errors

Emotion Less / Disciplined

Automation

Low Impact Cost

Large Trade, Takes Time

Limited Stocks Scan

Chances of Human Errors

Gut Feeling Involve

Manual

High Impact Cost

Support for Multiple Languages

Why Religare?

30+ Years of Trust

1500+ Touch Points

1.1 Million+ Customers Onboarded

Client Centric Approach

Advanced Technology and Innovation

Free Research Recommendations

Why Religare?

30+ Years

of Trust

Client Centric

Approach

1500+

Touch Points

Advanced Technology

and Innovation

1.1 Million+

Customers Onboarded

Free Research

Recommendations

Frequently Asked Questions

How does algorithmic trading work?

It uses advanced mathematical models and logic to identify opportunities, send trade orders to exchanges, and execute them without human intervention.