Zero Brokerage Unlimited Trades! Across all Segments

in a few minutes

Opening Fees

For 1st Year

Trading Platform

RM Support

Features of Zero Brokerage

Simplify your trading journey with intuitive tools and expert support at your fingertips!

Access free research recommendations from market experts to help you make informed trading decisions. Stay updated with expert insights and strategies at no extra cost.

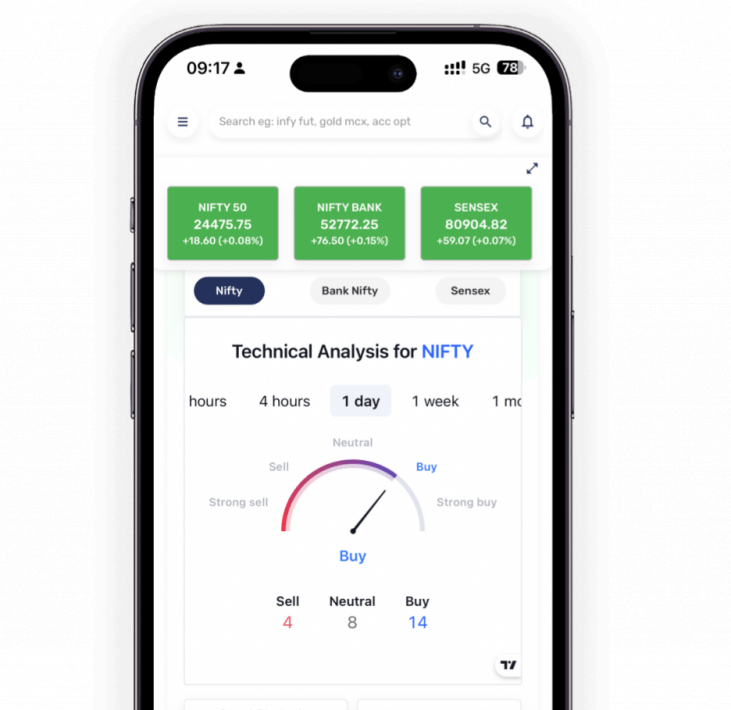

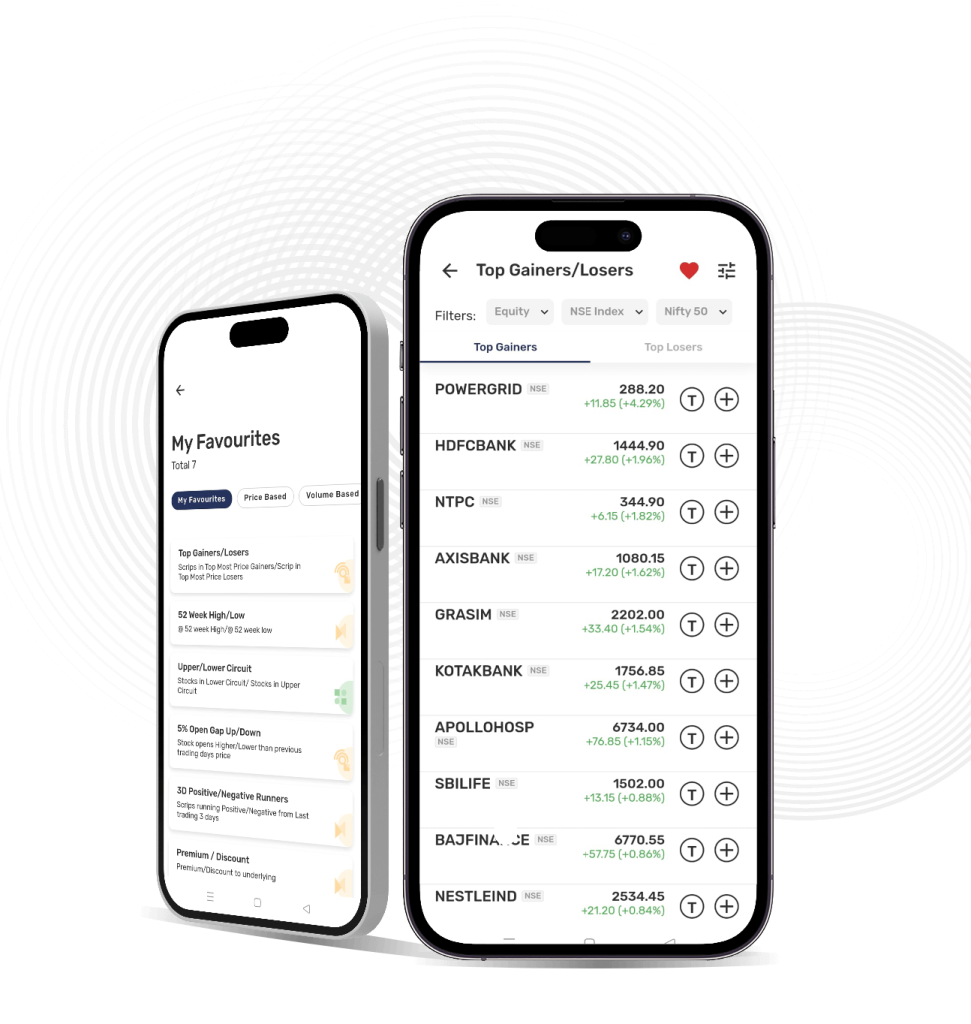

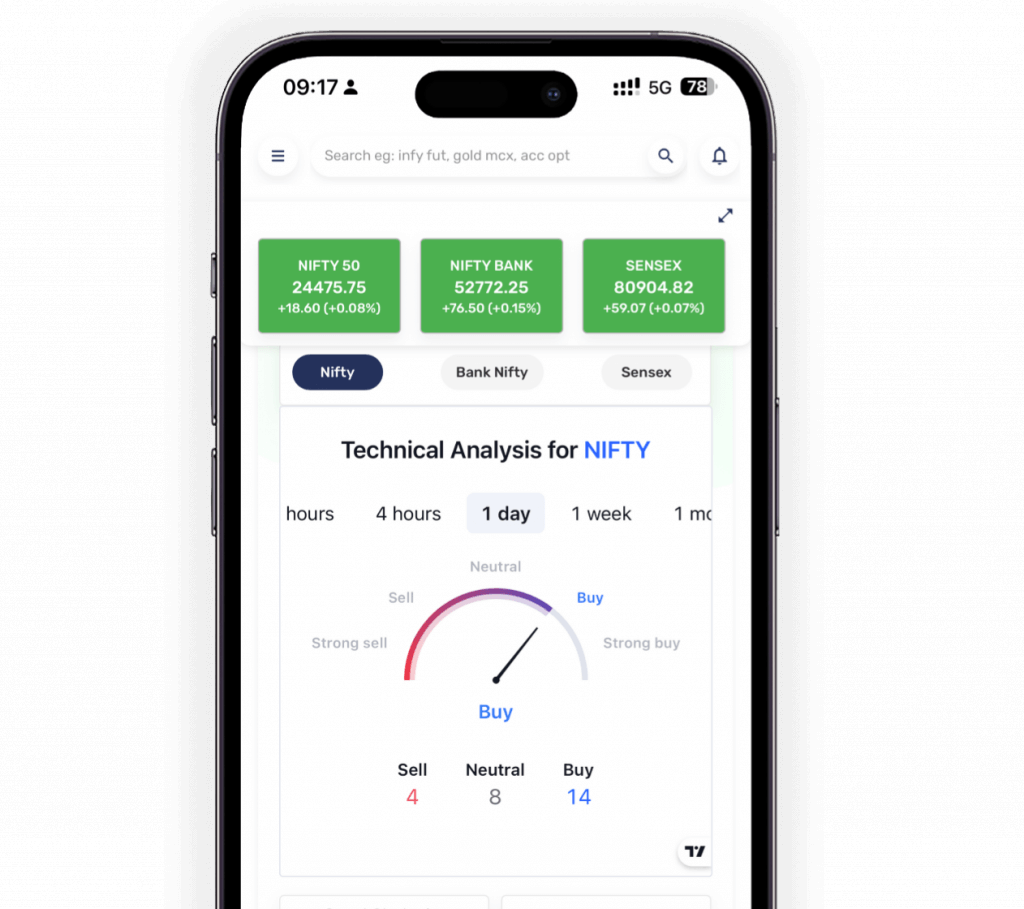

Experience cutting-edge technology with an all-in-one intuitive platform designed to streamline your trading and investment journey. Manage portfolios, execute trades, and explore opportunities seamlessly in one place.

Trade beyond your available capital and capture bigger opportunities. Profit from both rising and falling markets with margin and short-selling options.

Multiple order types like Market Order, Limit Order, Stop Loss Trigger Order, Intraday Order, Delivery Order, Multi-leg Order, GTD Order and more.

Easily diversify your portfolio by investing in Mutual Funds, IPOs, US Stocks, NFOs, NCDs, and more—all directly from your dashboard. Access a wide range of instruments in one convenient and user-friendly platform.

Features of Zero Brokerage

Simplify your trading journey with intuitive tools and expert support at your fingertips!

Access free research recommendations from market experts to help you make informed trading decisions. Stay updated with expert insights and strategies at no extra cost.

Experience cutting-edge technology with an all-in-one intuitive platform designed to streamline your trading and investment journey. Manage portfolios, execute trades, and explore opportunities seamlessly in one place.

Trade beyond your available capital and capture bigger opportunities. Profit from both rising and falling markets with margin and short-selling options.

Multiple order types like Market Order, Limit Order, Stop Loss Trigger Order, Intraday Order, Delivery Order, Multi-leg Order, GTD Order and more.

Easily diversify your portfolio by investing in Mutual Funds, IPOs, US Stocks, NFOs, NCDs, and more—all directly from your dashboard. Access a wide range of instruments in one convenient and user-friendly platform.

Experience Personalized Services! Invest with Confidence!

Stocks & ETF’s

IPO & NFO

Expert Research Advice

Currency & Commodity

Mutual Funds

Margin Trading Fund

Margin Pledge

Portfolio Tracker

Global Investing

Insurance

Experience Personalized Services! Invest with Confidence!

Stocks & ETF’s

Margin Trading Fund

IPO & NFO

Margin Pledge

Expert Research Advice

Portfolio Tracker

Currency & Commodity

Global Investing

Mutual Funds

Insurance

Stocks & ETF’s

IPO & NFO

Expert Research Advice

Currency & Commodity

Mutual Funds

Margin Trading Fund

Margin Pledge

Portfolio Tracker

Global Investing

Insurance

Why Religare?

Why Religare?

25+ Years

of Trust

Client Centric

Approach

1700+

Touch Points

Advanced Technology

and Innovation

1 Million+

Customers Onboarded

Award

Winning Research

Frequently Asked Questions

Why do I need a Demat account?

A Demat account is essential for holding and trading securities such as stocks, mutual funds, and bonds in electronic format. It eliminates the need for physical share certificates, making the investment process safer, faster, and more convenient.

Who can open a Demat account?

Any individual aged 18 years or above with valid KYC documents can open a Demat account. This includes a PAN card, Aadhaar card, and proof of address.

How can I open a Demat Account with Religare?

Here is a step-by-step process of opening a demat account with Religare Broking

- Fill your identity details like name, email ID, phone number, address & PAN card number.

- Add your bank details such as bank account number, type of account and IFSC code.

- Upload required documents such as passport sized photo, address proof & identity proof.

- Verify your identity by e-signing through Aadhaar based OTP verification

How long does it take to open an account after KYC completion?

The Religare trading & demat account will be opened within 24 hours after the KYC verification and accurate document submission.

Is it mandatory to link a bank account to my Demat account?

Yes, linking your bank account is mandatory. It ensures secure and easy fund transfers between your trading and bank accounts.