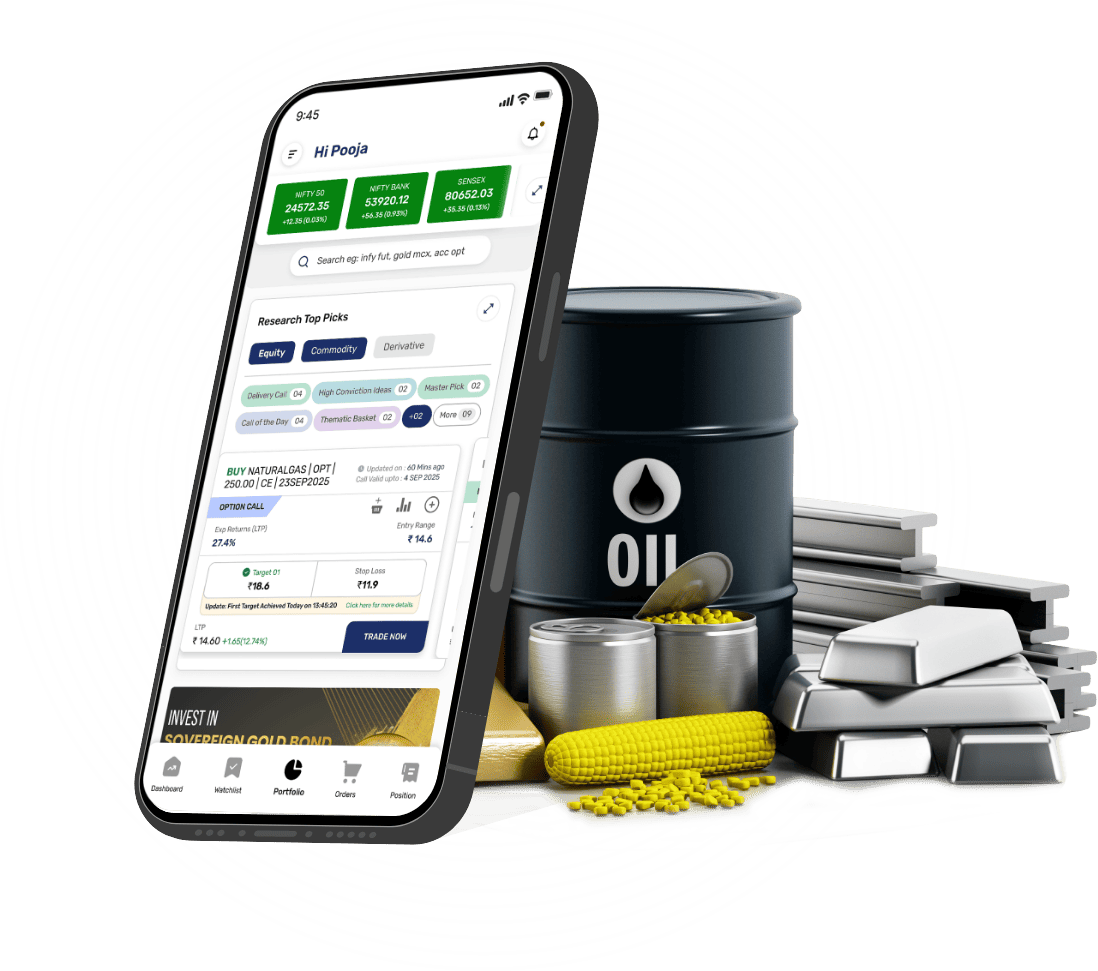

Diversify your Investments Gold, Oil, Silver & More

in a few minutes

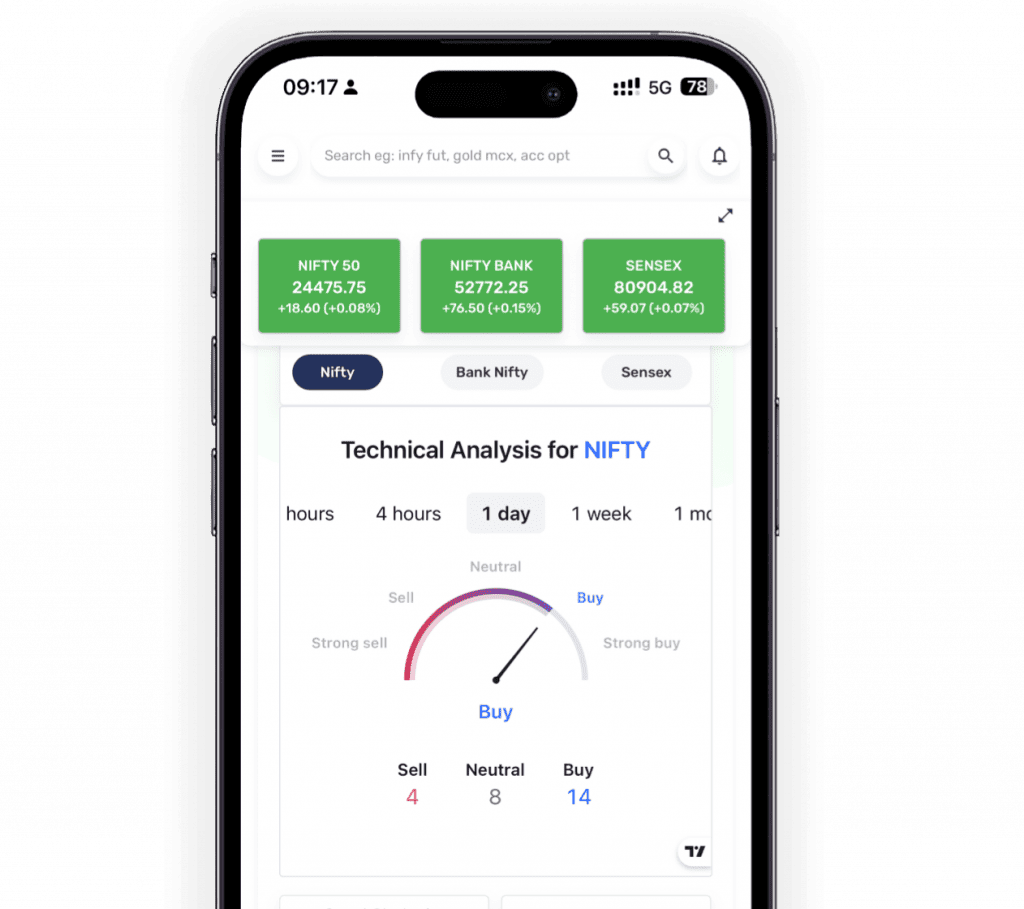

Navigate with Confidence

Smart Hedging

Powerful Insights

Instant Orders

Types of Commodity

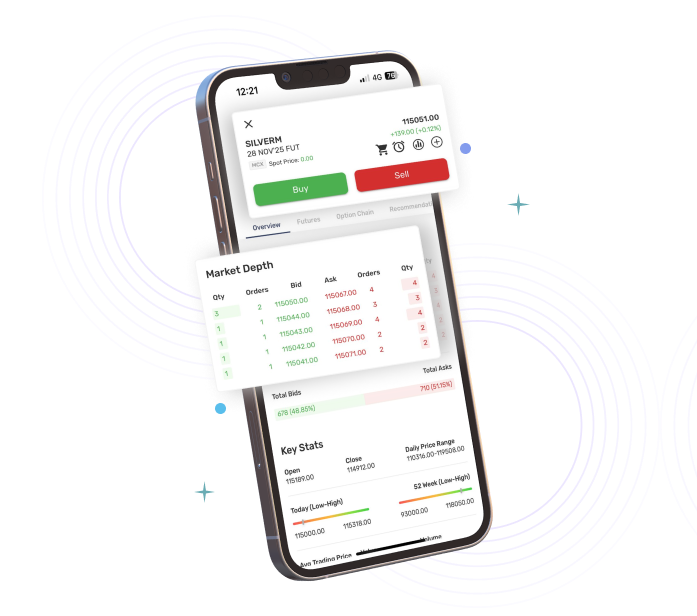

Commodity Futures

Tap into powerful trading opportunities across commodities with seamless futures trading.

Commodity Options

From gold to energy, unlock smarter trading with Commodity Options.

Commodity Futures

Trade Global Commodities

Access gold, silver, crude oil, and more with a single platform.

Leverage Price Movements

Maximize your market potential with minimal margin requirements.

Hedge Against Volatility

Protect your portfolio from commodity price fluctuations with effective strategies.

Real-Time Market Insights

Stay ahead with live prices, analytics, and expert research.

Commodity Options

Flexible Trading Strategies

Hedge and manage volatility with cost-efficient options.

Defined Risk Exposure

Control your downside with predetermined risk and limited capital outlay.

Diversify Across Commodities

Trade gold, crude, and other key commodities from one platform.

Data-Driven Decisions

Leverage real-time analytics and expert insights to stay ahead.

Why Choose Religare Broking

Advanced Tools & Analytics

Smart Options Strategies

Live Market Insights

Seamless Execution

Expert Research Support

User-Friendly Platformn

Zero Account

Opening

Free Research

Recommendations

Free AMC for

1st Year

Advanced

Charting Tools

Experience Personalized Services! Invest with Confidence!

Stocks & ETF’s

IPO & NFO

Expert Research Advice

Currency & Commodity

Mutual Funds

Margin Trading Fund

Margin Pledge

Portfolio Tracker

Global Investing

Insurance

Frequently Asked Questions

What is a Commodity Exchange?

A commodity exchange is an association or a company or any other body corporate that enforces rules and regulations for trading commodity contracts and interconnected investment products.

Who regulates commodity trading in the country?

Commodity trading in India is regulated by the Securities and Exchange Board or SEBI. In addition to this, the Commodity Derivatives Market Regulation Department or CDMRD overlooks the everyday operations of trading.

What are the different types of participants in commodity markets?

Commodity Market participants can be classified into three major categories i.e. hedgers, arbitragers, and speculators. In other words, manufacturers, traders, farmers, exporters, and investors are all the participants in this market.

How is trading done in the commodity exchanges?

Transactions in commodity exchanges are based on the online trading system. It is an order-driven trading platform, which is reachable to the various participants through the internet, VSAT, and leased line modes operated by members or subbrokers spread across the country.

What are the pros of commodity trading?

Commodity trading lets individuals place comparatively bigger bets with a small amount of money. This increases their chances of earning significant profits. These investments also offer liquidity.

What is a derivative contract?

A derivative is a product where the derivative value is derived from the value of one or more underlying variable or asset in a contractual manner. The asset can be equity, foreign exchange, commodity or any other asset.

What are commodity futures?

Commodity futures are like index or stock futures. They serve as a contract to buy and sell commodities at a future date and time.

How are futures prices determined?

Futures prices are determined by the interaction of bids and fluctuations in that asset across the country which converges on the trading floor. The bid and offer prices are based on the fluctuations of prices on the maturity date.

Who can invest in commodities?

Farmers, investors, importers, exporters, large scale consumers like jewellers, textile mill owners, agricultural credit providing firms, speculators, etc. commonly trade commodities in India.