Secure your Health through our Hospicash Insurance - Exclusive Offer for RBL customers

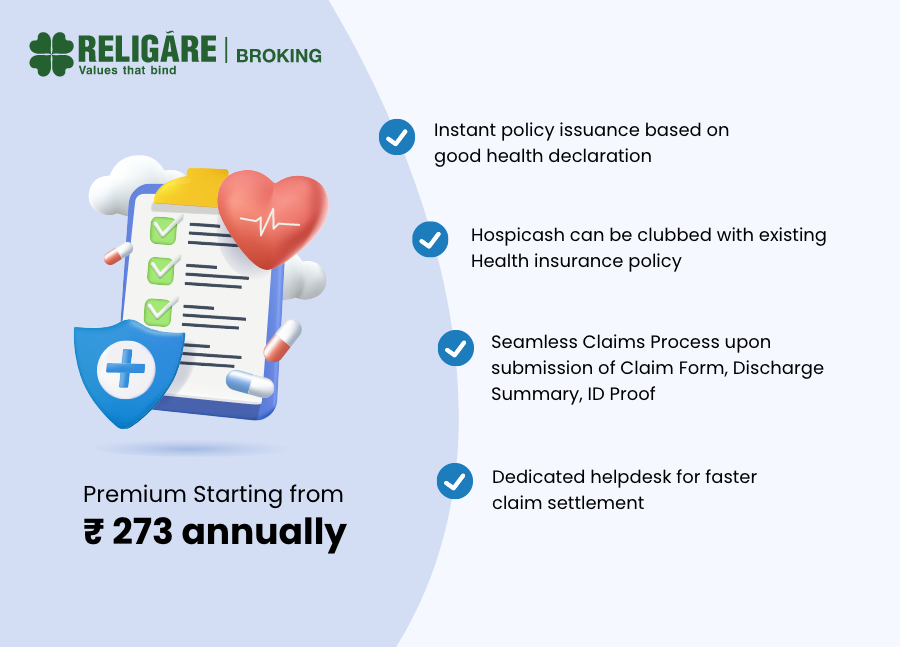

USP of Hospicash

Lowest Premium

Pay an annual Premium of Rs. 1421/- and get covered up to Rs 1,80,000. per year with 1 day deductible and daily hospicash limit of Rs 2,000 per day.

Tax benefits

The premium paid towards a health insurance policy in India can be claimed for tax deduction under Section 80D of the Income Tax Act of 1961. You can avail of a tax deduction of up to INR 25,000 for premiums paid towards hospital cash insurance

Comprehensive coverage:

Get comprehensive coverage of: 90 days in a year with 1 day deductible for hospitalization resulting due to Illness and Injuries.

No Pre-policy Medical Check-up

One of the main key highlights of hospicash is that no pre-policy medical check ups are conducted to get insured. Policy is issued on the basis of a Good health declaration made by the insurer.

Covers Expense related to hospitalization

Daily hospital cash benefit helps to take care of the expenses that are not covered under the comprehensive health insurance policy, and also can take care of extra expenses that you might incur during hospitalization. Get lump-sum benefits which can cater to routine expenses incurred during hospitalization.

Simple claim process:

Reimbursement Claim refers to the type of claim wherein an insured must pay for the medical costs and treatment out of their pocket and later claim the bill from the insurance provider. Get all your expenses reimbursed with the seamless claims process upon the submission of Claim Form, Discharge Summary & ID Proof.

Features of Hospital Cash Insurance?

The insured must be hospitalised for a minimum of 24 to 48 hours to avail of hospital daily cash benefit.

No supporting bills are required to claim this benefit; valid hospitalisation proof is enough.

The daily cash amount can range from Rs. 500 /- to Rs. 2,000/- depending on your policy’s terms and conditions.

There’s a waiting period during which you cannot make any claims. However, in case of accidents, the waiting period is not applicable.

Most hospicash insurance policies have a deductible of 1 day or 24 hours that the policyholder must pay to activate the policy. For instance, if you are admitted to the hospital for 5 days, you will be eligible for a hospicash benefit of 4 days after the one-day deductible is paid by you

FAQs

Yes, it is different. Hospitalization coverage under health insurance plans covers hospitalization costs such as room rent, consultation fees, diagnostic tests, medicines, etc. Unlike basic hospitalization cover, a hospital cash benefit is a fixed amount paid to the insured for a certain number of days during hospitalization. You can use this for personal expenses like food, travel, etc.

Hospital cash cover is offered only for RBL customers currently.

Yes, the insurance can be canceled within 15 days of enrollment on a pro-rata basis.