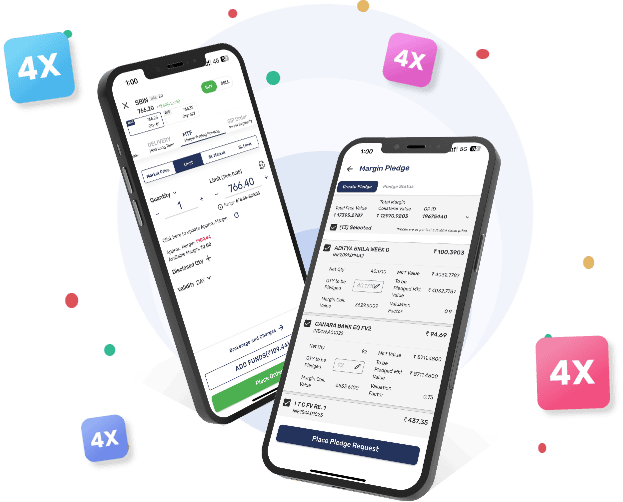

Use margin pledge to get upto

4X against your portfolio

in a few minutes

By signing up, you agree to receive updates on SMS, Email & WhatsApp

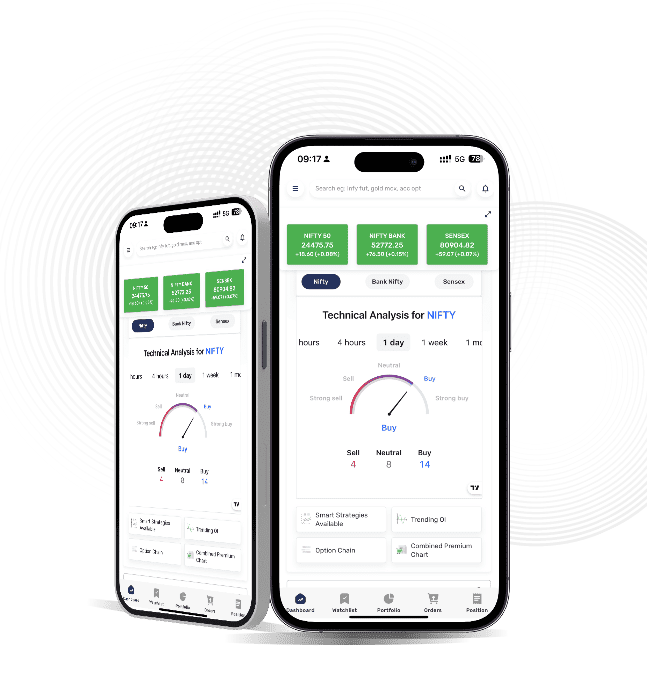

Buying Power

Market Opportunities

Trading

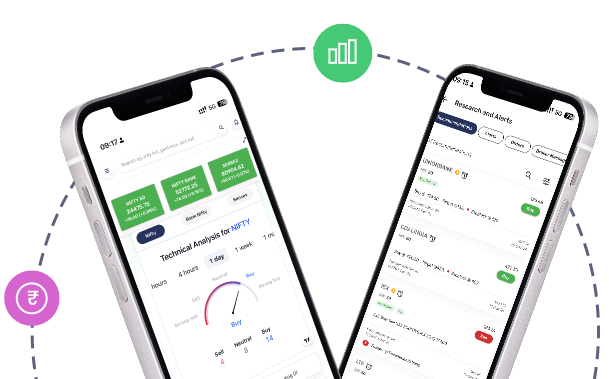

Research

Features of Margin Trading Facility (MTF)

Allows traders to take advantage of market opportunities by leveraging funds, enabling them to buy securities without paying the entire amount upfront, thus maximizing potential returns with limited initial investment.

Enables investors to leverage the existing securities in their portfolio by pledging them as collateral, providing a cost-effective way to meet margin requirements without the need to liquidate holdings or infuse additional cash.

Empowers investors to spread their investments across a variety of stocks even with limited available capital, reducing risk by not relying on a single security while taking advantage of market opportunities in different sectors or companies, all through the use of leveraged funds.

It operates under the strict regulatory framework set by the Securities and Exchange Board of India (SEBI), ensuring that it adheres to compliance standards designed to protect investors and maintain market integrity.

Traders and investors can access detailed, expert-driven insights and strategies, including comprehensive trading tips to navigate market fluctuations, innovative investment ideas for long-term growth, and actionable intraday trading recommendations that offer short-term profit opportunities.

Features of Margin Trading Facility (MTF)

Enhanced Market Opportunities

Allows traders to take advantage of market opportunities by leveraging funds, enabling them to buy securities without paying the entire amount upfront, thus maximizing potential returns with limited initial investment.

Collateral Flexibility

Enables investors to leverage the existing securities in their portfolio by pledging them as collateral, providing a cost-effective way to meet margin requirements without the need to liquidate holdings or infuse additional cash.

Diversified Investments

Empowers investors to spread their investments across a variety of stocks even with limited available capital, reducing risk by not relying on a single security while taking advantage of market opportunities in different sectors or companies, all through the use of leveraged funds.

Regulatory Compliance

It operates under the strict regulatory framework set by the Securities and Exchange Board of India (SEBI), ensuring that it adheres to compliance standards designed to protect investors and maintain market integrity.

Quality Research

Traders and investors can access detailed, expert-driven insights and strategies, including comprehensive trading tips to navigate market fluctuations, innovative investment ideas for long-term growth, and actionable intraday trading recommendations that offer short-term profit opportunities.

Trade More with Less Capital Using MTF

Why Religare?

25+ Years of Trust

1700+ Touch Points

1 Million+ Customers Onboarded

Client Centric Approach

Advanced Technology and Innovation

Award Winning Research