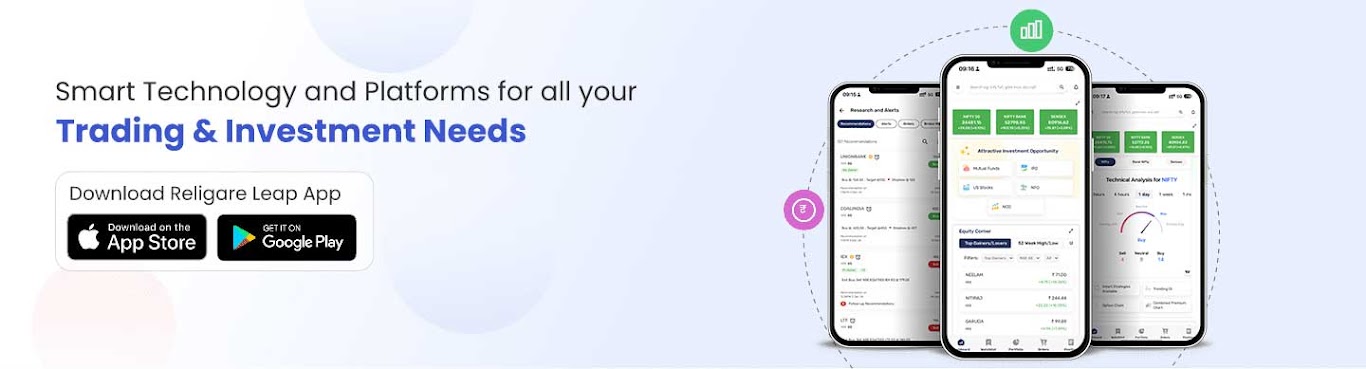

All-in-One App

Comprehensive Investment

& Trading App “LEAP”

Basket of Products

Access to a wide variety of online trading & investment products

Customer Support

Dedicated relationship manager assistance for all your trading needs

Quality Research

In- depth trading tips, investment ideas & intraday trading recommendations

Find the Perfect Product

to match your Investment Needs

Stocks & IPOs

Futures & Options

Mutual Funds & ETFs

Currency & Commodity

Smart Invest

Global Investing

Insurance

NPS

Frequently asked questions

A demat account, short for “dematerialized account,” is like a digital vault for your stocks and securities. It holds them in electronic form instead of physical certificates. It makes buying, selling and transferring shares easier in the stock market, eliminating the need for paperwork. It is where your investments are stored and managed electronically. A trading account helps you in buying/selling of these securities.

NRIs can open NRE and NRO bank accounts in India. The differences between an NRE and NRO bank accounts are as follows:

Acronym | NRE is Non Resident External Account | NRO is Non Resident Ordinary Account |

What is NRE/NRO? | NRE account is used to transfer an NRI’s foreign earnings to India. | NRO account helps an NRI to manage his/her income earned in India |

Taxation

| The interest paid by bank is tax-free. | The interest earned is taxable.

|

Repatriability | Balances are fully repatriable | Repatriation is as per certain limits and conditions. |

Deposits & Withdrawals

| The deposits can be made in any foreign currency, but withdrawals are allowed only in INR. | The deposits are made in any currency including INR, but withdrawals are in INR. |

A Portfolio Investment Scheme (PIS) account is a bank account that allows Non-Resident Indians (NRIs) to buy and sell shares and convertible debentures of Listed Indian companies on recognized stock exchanges on repatriable basis.

NRIs can get the PIS letter with the help of the bank where the NRE or NRO account is opened. RBI has authorised only designated branches of a bank to administer the PIS.

To open a Religare NRI demat & trading Account, NRIs must open a PIS account with any one of the following banks: Axis Bank, HDFC Bank, ICICI bank, IndusInd bank, Kotak Mahindra Bank and Yes Bank.

An NRI, PIO or OCI, mariner/seafarer can open an NRI Demat & Trading Account permitting Investment in Indian Securities and trading on Indian Stock Exchanges.

To open a Religare NRI demat & trading account, you need following:

● Valid Indian or overseas passport

● Visa/ PIO or OCI card/ place of birth is India on foreign passport

● Operative pan card

● Overseas address proof

● TIN/FATCA proof

● Photo

● Proof of NRE/NRO savings bank A/C

● PIS Letter

NRIs need the following accounts to trade in India:

- Fill up the account opening form. (https://www.religareonline.com/wp-content/uploads/2024/09/AOF-01-09-2024.zip)

- In case you are in India, you may visit any of our branches with documents. Our team will assist you throughout in the account opening journey.

- In case you are in a foreign country, all KYC documents should be self-attested by you and also attested by any one of the following in the country of residence and courier the filled and attested documents to us for opening your account.

To apply for NRI demat & trading account, submitting proof of overseas address is mandatory. Indian address proof is required if Indian address is shared for correspondence.

INDIAN ADDRESS | OVERSEAS ADDRESS |

Passport with Indian address | Passport with overseas address |

Voter ID card | Government issued ID card with overseas address/ OCI card |

Driving license with Indian address | Driving license with overseas address |

Aadhar (with masking & consent letter) | Utility bill, not more than 2 months old |

NREGA job card | Bank statement (not more than 2 months old) or passbook of any Indian Bank NRE/NRO account with overseas address |

Yes, NRIs are allowed to invest in futures & options segment of the exchange out of Rupee funds held in India on non repatriation basis, subject to the limits prescribed by SEBI

NRIs can trade in F&O through Religare NRO Trading account. To trade in F&O, NRIs need to open a custodial account and obtain a custodial participant (CP) code. Religare has partnered with Orbis to help NRI clients obtain a CP code.

Copyright 2025 Religare. Trademarks are the property of their respective owners. All rights reserved. Please note that by submitting your mobile and email on our website, you are authorizing us to Call/SMS/Whtsapp/Email you even though you may be registered under the DNC. We shall Call/SMS you for a period of 6 months.

Religare Broking Limited (CIN: U65999DL2016PLC314319) Registered Office: Religare Broking Limited, 802 -815B, 8th Floor, Gopal Das Bhawan, 28-Barakhamba Road, Connaught Place, New Delhi - 110001. Board line number: +91-011-49871213, Fax No. +91-011-49871189. Member Religare Broking Limited (RBL) : SEBI Regn. No. INZ000330135 NSE CM, F&O, CD TM Code: 06537 Clearing Member (F&O) No. M50235; BSE CM, F&O, CD, CO Code: 3004 Clearing No: 3004; MSE CM, F&O, CD, TM Code: 1051| MCX Membership No. 56560 | NCDEX Membership No. 01276 | AMFI ARN No.139809. Depository Participant : Religare Broking Limited (RBL) – NSDL: DP ID: IN 301774 | SEBI Regn. No: IN-DP-385-2018 | CDSL DP ID: 30200 | SEBI Regn. No: IN-DP-385-2018. Research Analyst: Religare Broking Limited (RBL) – SEBI Regn. No: INH100006977 | BSE Ltd. (RAASB) Enlistment No. 5334 | Registrars to an issue and share Transfer Agents (RTA) - SEBI Regi. No : INR000004361 | Corporate Agent (Composite) - IRDA Regi. No : CA0581 | National Pension System - Point of Presence (NPS-POP) - PFRDA Regi. No : POP01092018.

Disclaimer: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. RBL is a distributor of Mutual Funds / IPOs / Insurance / Bonds & NCDs / Corporate FDs etc. Equities, Currencies & Depository Services are offered through Religare Broking Ltd. All disputes with respect to the distribution activity / Insurance services would not have access to Stock Exchanges investor redressal forum or Arbitration mechanism. The securities are quoted as an example and not as a recommendation |

https://religareonline.com/disclaimer | T&C Apply*