Unlease the power of OptionTrading

in a few minutes

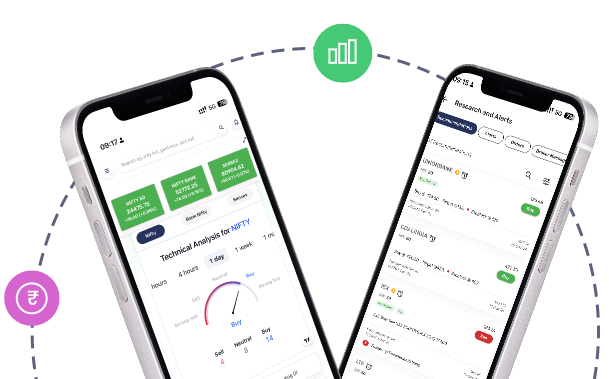

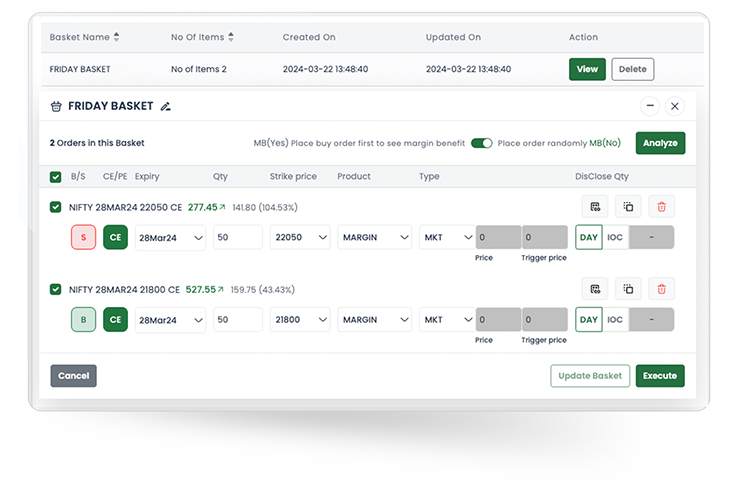

Directly From Option Chain

Order Execution

User Interface

Strategies Builder

Trade Options like a Pro!

Elevate your portfolio with expert Options Strategies

Analyze pricing, liquidity, sentiment, and potential profitability across different options, supporting more informed trading decisions. Place multiple orders at the same time. This can be useful for executing complex options strategies or for entering and exiting positions quickly.

The Trending OI feature tracks cumulative OI changes for chosen strike prices, showing options activity over custom intervals (up to 60 minutes). It helps traders spot momentum shifts and uncover potential trading opportunities.

This chart displays the combined premium of multiple options contracts by summing their individual premiums. It helps traders compare premiums or track the overall cost of specific options strategies on a single chart.

In addition to basic option contract details, Implied Volatility (IV) provides traders with an estimate of future volatility, impacting the option’s premium. With Greeks, traders can measure an option’s sensitivity to factors like price changes or time decay.

The Smart Strategy Finder helps users select strategies based on their market view—Positive, Negative, or Neutral. It suggests suitable options with details like Maximum Profit, Maximum Loss, and break-even, tailored to their risk appetite.

Trade Options like a Pro!

Elevate Your Portfolio with Expert Options Strategies

Option Chain

Analyze pricing, liquidity, sentiment, and potential profitability across different options, supporting more informed trading decisions. Place multiple orders at the same time. This can be useful for executing complex options strategies or for entering and exiting positions quickly.

Trending OI

The Trending OI feature tracks cumulative OI changes for chosen strike prices, showing options activity over custom intervals (up to 60 minutes). It helps traders spot momentum shifts and uncover potential trading opportunities.

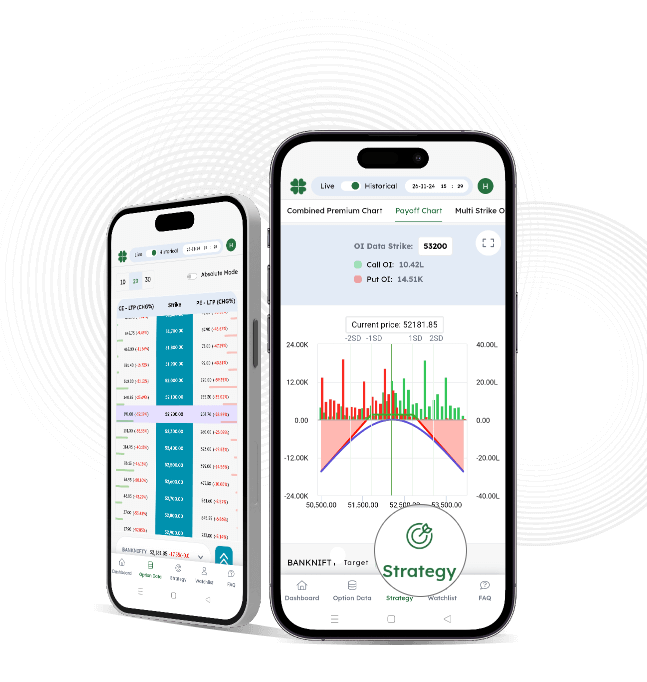

Combined Premium Chart

This chart displays the combined premium of multiple options contracts by summing their individual premiums. It helps traders compare premiums or track the overall cost of specific options strategies on a single chart.

Implied Volatility

In addition to basic option contract details, Implied Volatility (IV) provides traders with an estimate of future volatility, impacting the option’s premium. With Greeks, traders can measure an option’s sensitivity to factors like price changes or time decay.

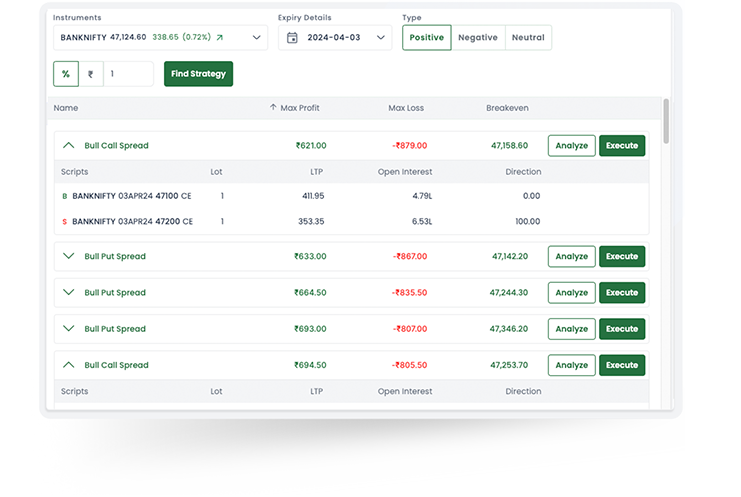

Smart Strategies

The Smart Strategy Finder helps users select strategies based on their market view—Positive, Negative, or Neutral. It suggests suitable options with details like Maximum Profit, Maximum Loss, and break-even, tailored to their risk appetite.

Experience Options Trading in Full View

-

Analyze Trend

Analyze market trends using OI statistics. Options Trading provides Trending OI feature to understand the market sentiment so that users can easily predict the market direction and execute strategies based on trend.

-

Identify Opportunities

Strategies tailored to market trends. Users can select profitable strategies based on trend using the find strategy feature.

-

Execute strategy seamlessly

Quick and easy order execution. Users can select profitable strategies based on trend using the find strategy feature..

-

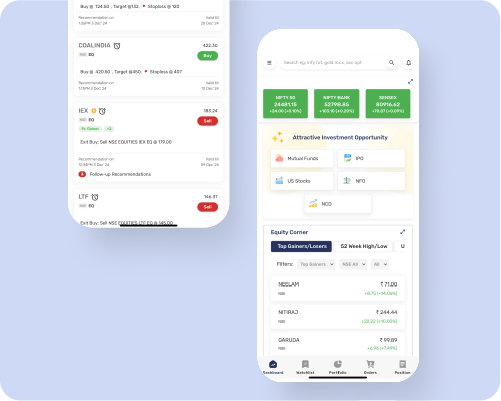

Research Dashboard

Stay ahead with our all-in-one Research Dashboard — insights, strategies, and market calls at your fingertips.

Why Religare?

30+ Years of Trust

1500+ Touch Points

1.1 Million+ Customers Onboarded

Client Centric Approach

Advanced Technology and Innovation

Free Research Recommendations

Why Religare?

30+ Years

of Trust

Client Centric

Approach

1500+

Touch Points

Advanced Technology

and Innovation

1.1 Million+

Customers Onboarded

Free Research

Recommendations

Frequently Asked Questions

What is an options contract?

An options contract gives the holder the right (but not the obligation) to buy or sell an underlying asset at a predetermined price (strike price) before or on a specified expiration date

How is options trading different from stock trading?

Unlike stock trading, where shares are directly bought or sold, options trading involves contracts that derive their value from an underlying asset. Options also have expiration dates and additional complexities like strike prices and Greeks.

What is the premium in options trading?

The premium is the price paid by the buyer to the seller to acquire the option contract.

What does 'strike price' mean?

The strike price is the agreed-upon price at which the underlying asset can be bought or sold when exercising the option.