One Stop Solution for all your Investment Needs

Select the plan of your choice

Religare LEAP

A plan for Online Traders & Investors

- Just ₹ 20 per executed order

Across equity, currency & commodity segments - Zero Account Opening Fee

To open a Demat + Trading account with Religare Broking - Free Research Recommendations

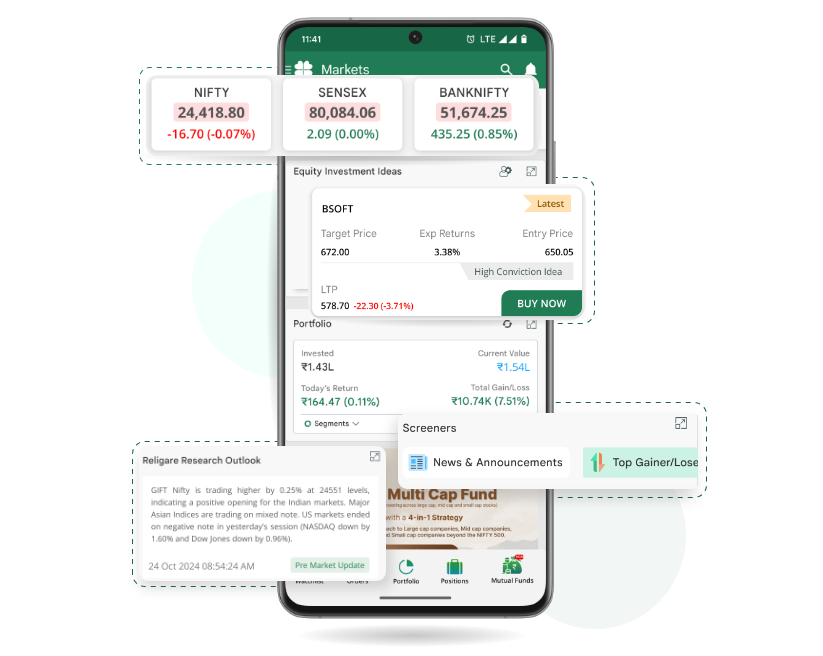

on Mobile App - Centralized Dealing Desk

Simple and intuitive mobile app – Leap for executing all your trades and a virtual relationship manager to help you with investment ideas

Religare ELITE

A personalised plan for Premium Customers

Brokerage as low as 1 paisa

Brokerage as low as 1 paisa

Turnover Based Brokerage Plans offering brokerage upto 1 paisa One Time Account Opening Offer

One Time Account Opening Offer

1 month Brokerage Free * upto Rs.1000

1 month Interest Free MTF- Personalised Services

Dedicated Relationship Manager for all your investment related needs - Strong Branch Network

Invest in Stocks, Insurance, SGB, Mutual Funds, NPS etc from our branches across the country

Experience Personalized Services!

Invest in a Bouquet of Products!