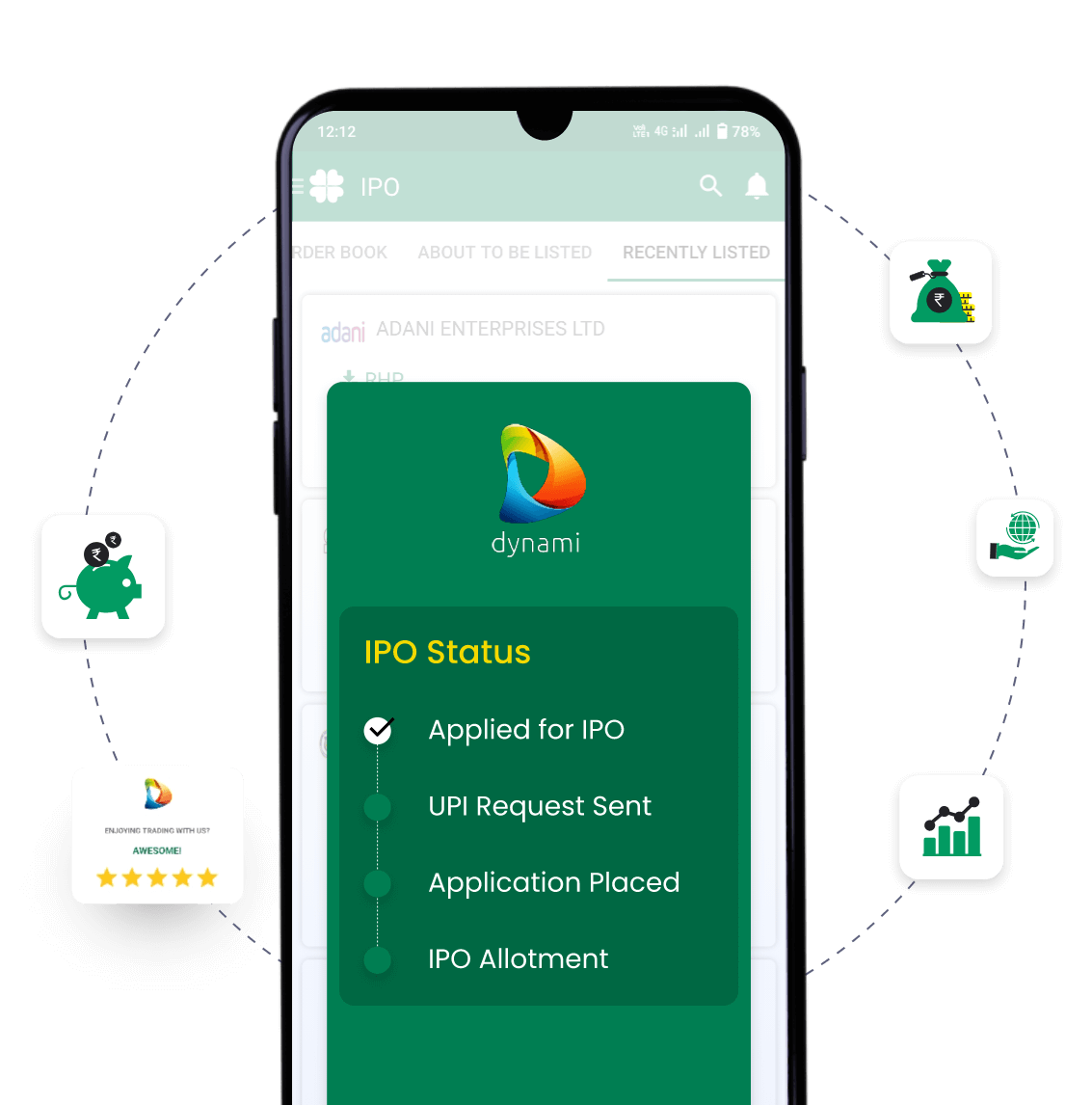

IPO Timeline

About Onest Ltd IPO

Onest Ltd is primarily engaged in the Fast Moving Consumer Goods (FMCG) market with a range of home care and personal care products, food products and household products catering to B2B2C and B2B customers. The Company is also engaged in the Non-Fast Moving Consumer Goods (Non-FMCG) market with a range of industrial products, catering to B2B customers. It is an emerging player to build a value brand in the home care and personal care industry. The Company has presence in five continents with major presence in African, Middle East, LATIN, SAARC, ASEAN and CIS countries. It has grown its revenue from operations at a CAGR of 69.55% between Financial Years 2021 and 2023 (from ₹641.13million, in Financial Year 2021 to ₹1,843.06million in Financial Year 2023). Further, the Company is also engaged in the business of private labelling with a focus and aim to establish a base in developed countries such as the USA and in the European markets.

Onest Ltd IPO Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| TBA | 0 | 0 | 90 | 0 |

| TBA | 0 | 0 | 0 | 0 |

Onest Ltd IPO Financial Status

| Particulars (in Rs. Crores) | FY 23 (In Cr.) | FY 22 (In Cr.) | FY 21 (In Cr.) |

|---|---|---|---|

| Total Income | 186.53 | 108.99 | 65.43 |

| PAT | 7.99 | 2.45 | 1.46 |

| Net Profit Margin | 4.34% | 2.27% | 2.27% |

| Return on Capital Employed | 21.35% | 19.16% | 26.61% |

| Net Debt/EBITDA Ratio | 1.30 | 0.16 | 1.20 |

Onest Ltd IPO SWOT Analysis

Strengths

- Diversified business segments with a wide range of products and consistent focus on quality.

- Professional turned entrepreneur Promoter with an experienced management team.

- Value brand, cost effective as compared to market competitors.

- International customer presence across geographies.

Risks

- Failure to adapt to changing consumer preferences and trends could negatively impact demand, operations, financial condition, and cash flows.

- Relying on third-party manufacturers exposes the company to risks that could negatively impact business, operations, cash flows, and financial condition.

- A loss of business in its homecare and personal care segment could adversely impact operations, financial condition, and cash flows.

- Damage to its brands and reputation could negatively impact business.

Frequently Asked Questions

The issue size is to be announced yet.

You can apply for the Onset Ltd IPO 2 days before the official subscription period begins using the pre-apply option.

Pre-applying for the Onset Ltd IPO lets you apply before it officially opens. Click on the Apply Now link to apply for (IPO name) on Religare Broking.

Your order will be submitted to the exchange as soon as bidding for Onset Ltd IPO begins. You will receive a UPI request within 24 hours after the bidding starts.

We will notify you when your Onset Ltd IPO order is placed with the exchange.

The open and close dates are yet to be announced.

The minimum lot size of the IPO is yet to be announced.

The minimum order quantity and investment required is yet to be announced.

The price band of the IPO is yet to be announced.

Upcoming IPOs Announced & Expected

Rajputana Stainless IPO

Announced

Registrar information

Name

Link Intime India Private Limited

Phone number

+91 810 811 4949

Email ID

onest.ipo@linkintime.co.in

Onest Ltd IPO

Onest Ltd IPO