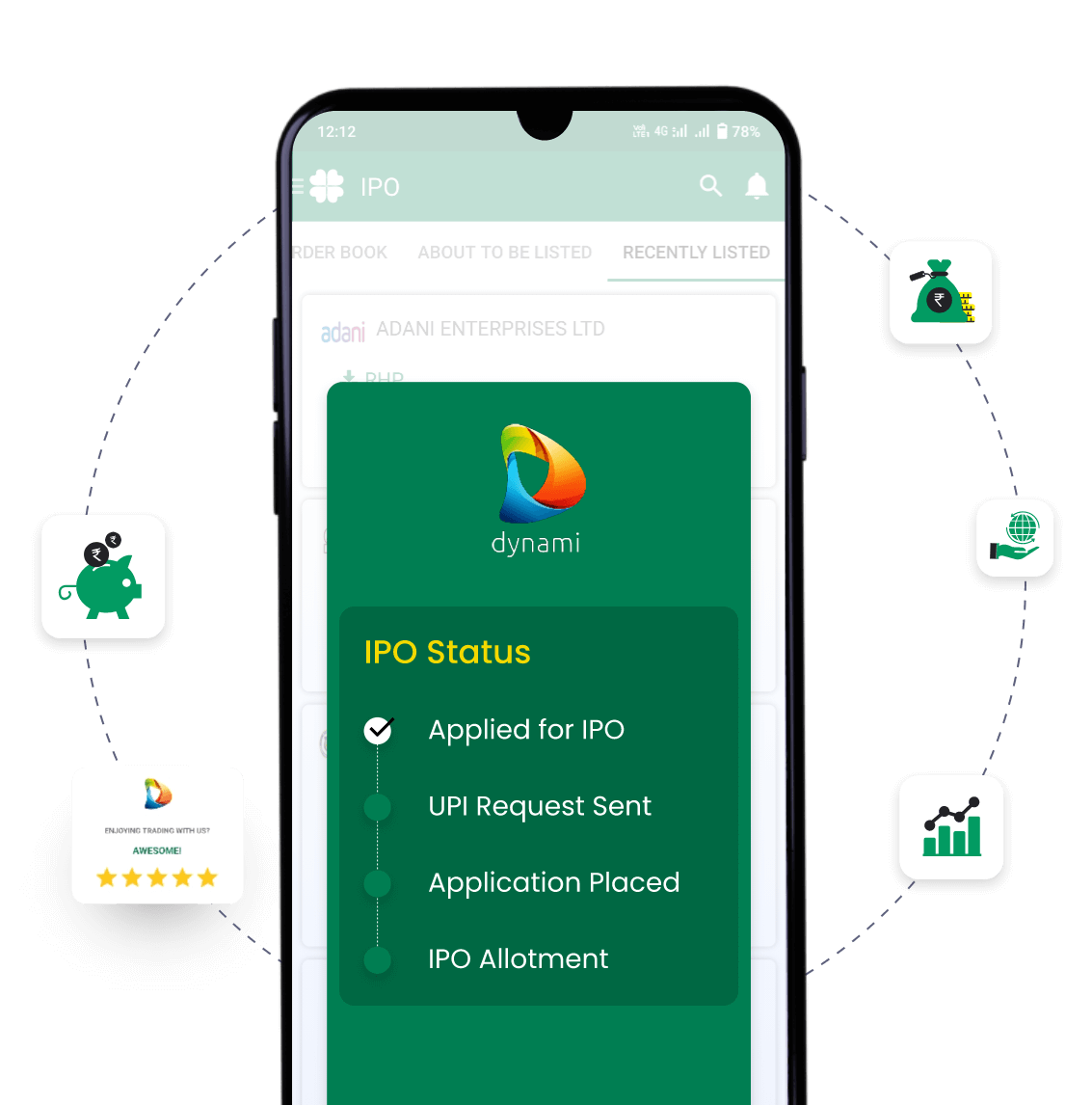

IPO Timeline

Started in 2009 as a private company in Kolkata, Pushpa Jewellers Limited became a public company in July 2024. Today, it trades gold jewellery wholesale to its clients anywhere in India and has interests overseas. The company designs, makes, and retails classic and modern gold jewellery containing fine stones such as Emerald, Jade, Pearl and Meena. The company provides for bulk buyers, retailers and institutional clients across India and exports to the UAE, USA and Australia. Thanks to over a decade of experience, Pushpa Jewellers blends fine traditions with modern trends to make stunning necklaces, bracelets, rings and earrings. The company plans to use the money raised by its IPO of up to 67,11,000 equity shares to support operations, boost expansion and make its brand more visible to customers.

Pushpa Jewellers Limited IPO Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| TBA | 0 | 0 | 90 | 0 |

| TBA | 0 | 0 | 0 | 0 |

Pushpa Jewellers Limited IPO Financial Status

| Particulars (in Rs. Crores) | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 | |

|---|---|---|---|---|

| Assets | 91.10 | 51.46 | 43.39 | |

| Revenue | 281.27 | 255.49 | 165.84 | |

| Profit After Tax | 22.29 | 13.58 | 8.14 | |

| Net Worth | 58.14 | 36.08 | 22.5 | |

| Reserves and Surplus | 39.28 | 35.84 | 22.27 | |

| Total Borrowing | 21.93 | 8.26 | 14.79 |

Pushpa Jewellers Limited IPO SWOT Analysis

Strengths

- Diverse Product Line: Sells a wide selection of older styles and fashionable jewellery using gems, such as emeralds and pearls, to suit different buyers.

- Established B2B Wholesaler: The company has grown as an established wholesaler in India and is now exporting to Dubai, the USA, and Australia.

- Experienced Leadership: Promoted by the Tibrewal family, who have built longstanding supplier and client relationships across the jewellery ecosystem.

- Operational Safeguards: Implements security protocols including CCTVs, armed guards, daily stock audits, and insurance coverage to reduce inventory and transit risks.

Weaknesses

- Compliance Lapses: A lot of delayed GST, EPF and ESIC filings in West Bengal, Telangana and Tamil Nadu between FY23 and FY25, which the company said were caused by issues with procedures or technology.

- Promoter Concentration: High dependence on promoters for strategy and operations may impact business continuity if leadership changes unexpectedly.

- Logistics Risk: Relies on third-party transport for product delivery; rising costs or infrastructure limitations may affect operations and margins.

- Foreign Exchange Sensitivity: Imports of raw materials and foreign market exposure make earnings susceptible to currency fluctuations, despite partial hedging plans.

Frequently Asked Questions

What is the issue size of Pushpa Jewellers Ltd IPO?

The issue size for Pushpa Jewellers Ltd IPO is ₹98.65 Cr

What is 'pre-apply' for Pushpa Jewellers Ltd IPO?

You can apply for the Pushpa Jewellers Ltd IPO 2 days before the official subscription period begins using the pre-apply option.

How can I pre-apply for Pushpa Jewellers Ltd IPO?

Pre-applying for the Pushpa Jewellers Ltd IPO lets you apply before it officially opens. Click on the Apply Now link to apply for Pushpa Jewellers Ltd IPO on Religare Broking.

If I pre-apply for Pushpa Jewellers Ltd IPO, when will my order get placed?

Your order will be submitted to the exchange as soon as bidding for Pushpa Jewellers Limited begins. You will receive a UPI request within 24 hours after the bidding starts.

When will I know if my Pushpa Jewellers Ltd IPO order is placed?

We will notify you when your Pushpa Jewellers order is placed with the exchange.

What are the open and close dates of the Pushpa Jewellers Ltd IPO?

The open date is 24 June’2025 and the closing date is 26 June’2025

What is the lot size of the Pushpa Jewellers Ltd IPO?

The lot size of the IPO is 1000 shares

What is the price band of the Pushpa Jewellers Ltd IPO?

The price band of the IPO is ₹143 to ₹147 per share

Upcoming IPOs Announced & Expected

Name

Cameo Corporate Services Limited

Phone number

+91 44-28460390

Email ID

investor@cameoindia.com