IPO Timeline

About Amagi Media Labs IPO

Founded in 2008, Amagi Media Labs Limited is a software-as-a-service (SaaS) provider that connects media companies with their audiences through cloud-native technology. Its platform enables content providers and distributors to upload and deliver video over the internet—commonly known as streaming—via smart televisions, smartphones, and applications, rather than through traditional cable or set-top box services. The company also supports content monetization through targeted advertising solutions for advertisers. The company’s technology has powered the streaming of marquee global events, including the 2024 Paris Olympics, Union of European Football Associations (UEFA) football tournaments, the Academy of Motion Picture Arts and Sciences Awards (the “Oscars”), and the 2024 U.S. presidential debates. According to the 1Lattice Report, the company is the media and entertainment industry’s only end-to-end, artificial intelligence–enabled cloud platform in the video category, serving as the sector’s “industry cloud.”

Amagi Media Labs IPO Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| TBA | 0 | 0 | 0 | 0 |

| TBA | 0 | 0 | 0 | 0 |

Amagi Media Labs IPO Financial Status

| Particulars (in Rs. Crores) | 30 Sep 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Assets | 1,352.16 | 1,425.00 | 1,308.08 | 1,405.96 |

| Total Income | 733.93 | 1,223.31 | 942.24 | 724.72 |

| Profit After Tax | 6.47 | -68.71 | -245.00 | -321.27 |

| EBITDA | 58.23 | 23.49 | -155.53 | -140.34 |

| Net Worth | 859.34 | 509.45 | 496.80 | 644.49 |

| Reserves and Surplus | -25.57 | 227.73 | -379.40 | -372.68 |

| Total Borrowing | 0.00 | 0.00 | 0.00 | 0.00 |

Amagi Media Labs IPO SWOT Analysis

Strengths

- One-stop glass-to-glass solutions provider.

- Positioned within a three-sided marketplace to leverage strong network effects.

- Proprietary, award-winning technology platform with artificial intelligence capabilities.

- Trusted by global customers with long-term relationships.

Risks

- Adverse impacts on streaming solutions could harm the company’s business.

- Past losses and negative cash flows may adversely affect the company’s business and share price.

- Economic downturns in key regions could hurt the company’s business.

- Failure to keep up with technology could affect the company’s growth.

Frequently Asked Questions

What is the issue size of Amagi Media Labs IPO?

The issue size for Amagi Media Labs IPO is ₹1789 Cr

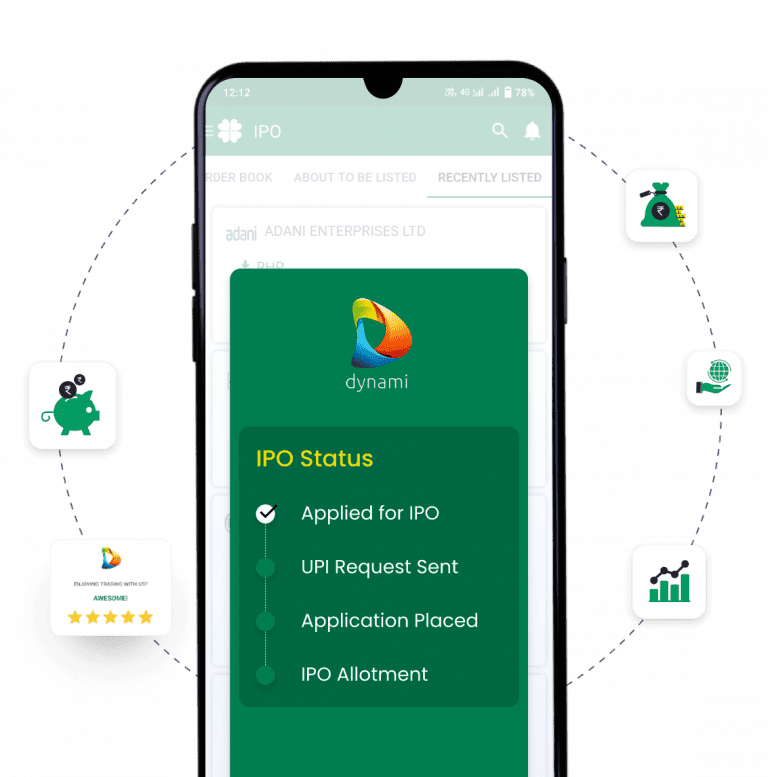

What is 'pre-apply' for Amagi Media Labs IPO?

You can apply for the Amagi Media Labs IPO 2 days before the official subscription period begins using the pre-apply option. |

How can I pre-apply for Amagi Media Labs IPO?

Pre-applying for the Amagi Media Labs IPO lets you apply before it officially opens. Click on the Apply Now link to apply for Amagi Media Labs IPO on Religare Broking.

If I pre-apply for Amagi Media Labs IPO, when will my order get placed?

Your order will be submitted to the exchange as soon as bidding for Amagi Media Labs begins. You will receive a UPI request within 24 hours after the bidding starts. |

When will I know if my Amagi Media Labs IPO order is placed?

We will notify you when your Amagi Media Labs order is placed with the exchange. |

What are the open and close dates of the Amagi Media Labs IPO?

The open date is 13 Jan’2026 and the closing date is 16 Jan’2026 |

What is the lot size of the Amagi Media Labs IPO?

The lot size of the IPO is 41 shares |

What is the price band of the Amagi Media Labs IPO?

The price band of the IPO is ₹343 to ₹361 per share |

Upcoming IPOs Announced & Expected

Bharat coking coal ipo

Announced

Registrar information

Name

MUFG Intime India Pvt.Ltd.

Phone number

+91-22-4918 6270

Email ID

amagimedia.ipo@in.mpms.mufg.com

Amagi Media Labs IPO

Amagi Media Labs IPO