IPO Timeline

About Cedaar Textile Limited IPO

Cedaar Textile Limited, which began in Bengaluru, Karnataka, in 2020, is a textile company that manufactures premium yarn. Most of the products at Textile Center are Polyester (both normal and recycled), Viscose, Cotton and Acrylic yarns, especially for the Indian fabric and garment industry. Cedaar operates from Punjab and has seen its production rise steadily since starting with more than 70,000 spindles. In March 2024, the company built a 2,000 KWP solar power facility using SIDBI loan funds since high power costs were a problem. In August 2024, Cedaar Textile was listed as a public limited company and now plans hopes to raise 43,50,000 equity shares to improve working capital, finance solar projects and support general purposes.

Cedaar Textile Limited Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| TBA | 0 | 0 | 0 | 0 |

| TBA | 0 | 0 | 0 | 0 |

Cedaar Textile Limited IPO Financial Status

| Particulars (in Rs. Crores) | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

|---|---|---|---|---|

| Assets | 222.77 | 198.23 | 175.84 | 154.45 |

| Revenue | 113.91 | 191.01 | 161.88 | 220.44 |

| Profit After Tax | 7.06 | 11.05 | 4.59 | 7.99 |

| EBITDA | 28.81 | 15.63 | 15.26 | |

| Net Worth | 60.70 | 25.24 | 14.19 | 9.6 |

| Reserves and Surplus | 51.17 | 17.74 | 13.94 | 9.35 |

| Total Borrowing | 120.63 | 146.15 | 137.01 | 121.01 |

Cedaar Textile Limited IPO SWOT Analysis

Strengths

- Diversified Yarn Production: The company makes polyesters (both normal and recycled), viscose, cotton and acrylic fibres to address different client requirements.

- Solar Energy Integration: To reduce electricity expenses and improve long-term efficiency, the company has installed a 2,000 KWP solar plant in 2024.

- Capacity & Infrastructure: Has a big manufacturing unit with a lot of installed spindle capacity to serve increasing demand.

- Strategic Location: Manufacturing base in Punjab ensures proximity to major textile markets and raw material sources.

Risks

- High Indebtedness: As of September 2024, total borrowings stood at ₹11,572.28 lakhs, limiting financial flexibility.

- No Long-term Supply Contracts: Relies on spot procurement of raw materials, exposing the company to price volatility and supply risks.

- Interest Rate Sensitivity: Most loans are at floating interest rates, exposing the business to changes in borrowing costs.

- First-Time Listing Risk: Being a debutant on the SME NSE Emerge platform, the stock’s post-listing performance remains uncertain.

Frequently Asked Questions

What is the issue size of Cedaar Textile Limited?

The issue size for Cedaar Textile Limited is ₹60.90 Cr

What is 'pre-apply' for Cedaar Textile Limited?

You can apply for the Cedaar Textile Limited 2 days before the official subscription period begins using the pre-apply option.

How can I pre-apply for Cedaar Textile Limited?

Pre-applying for the Cedaar Textile Limited lets you apply before it officially opens. Click on the Apply Now link to apply for Cedaar Textile Limited on Religare Broking.

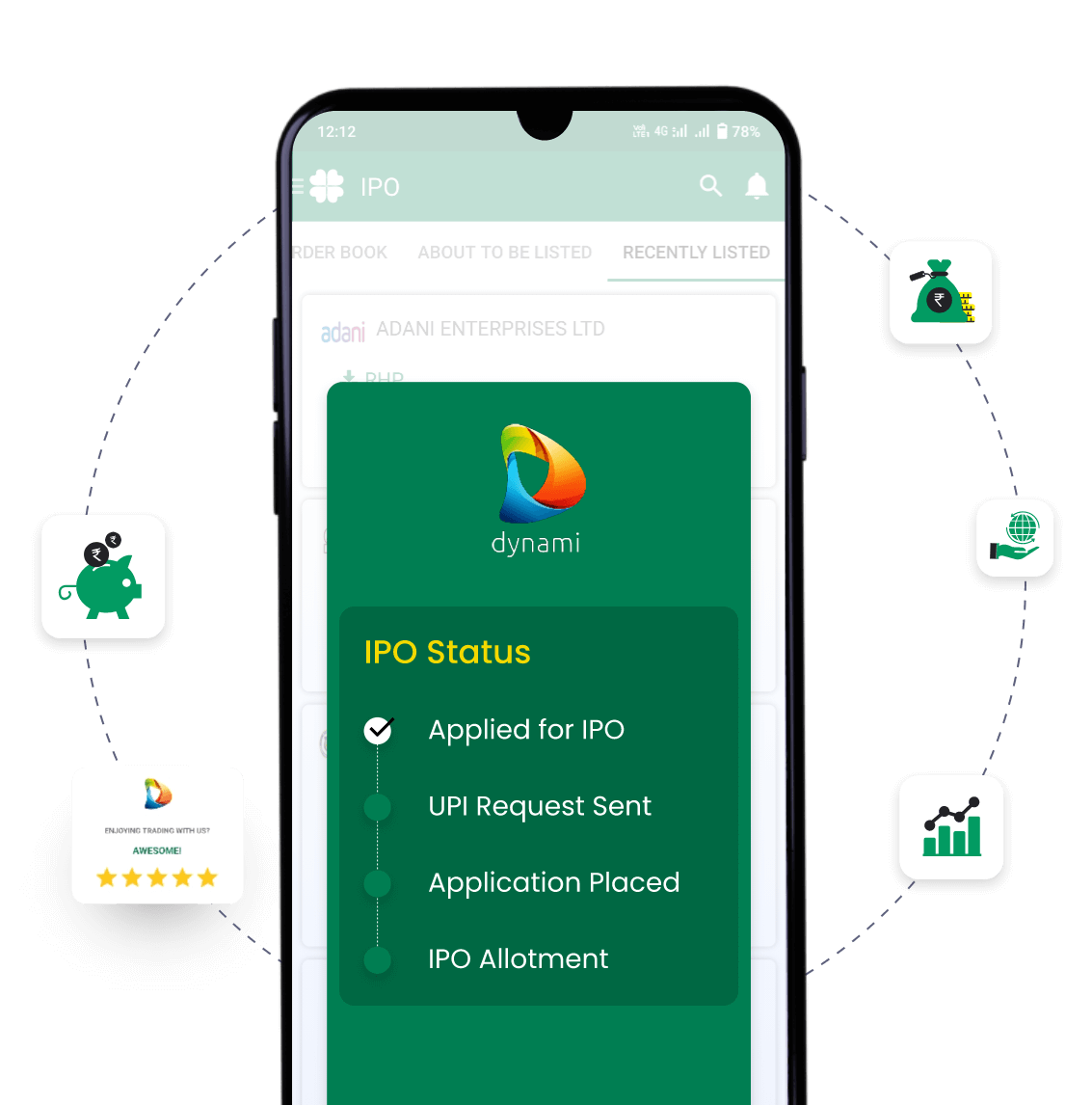

If I pre-apply for Cedaar Textile Limited, when will my order get placed?

Your order will be submitted to the exchange as soon as bidding for Cedaar Textile begins. You will receive a UPI request within 24 hours after the bidding starts.

When will I know if my Cedaar Textile Limited order is placed?

We will notify you when your Cedaar Textile order is placed with the exchange.

What are the open and close dates of the Cedaar Textile Limited?

The open date is 30 June’2025 and the closing date is 2 July’’2025

What is the lot size of the Cedaar Textile Limited?

The lot size of the IPO is 1000 shares

What is the price band of the Cedaar Textile Limited?

The price band of the IPO is ₹130 to ₹140 per share

Upcoming IPOs Announced & Expected

Registrar information

Name

Skyline Financial Services Private Ltd

Phone number

+91 02228511022

Email ID

ipo@skylinerta.com