IPO Timeline

About Deltatech Gaming IPO

Deltatech Gaming is a digitally native, technology led gaming platform, delivering a gamer-centric gaming experience across its various offerings. It is one of the earliest companies in the real money gaming segment in India and Adda52 is India’s first online poker platform offering multiple poker variants. It has been considered as a ‘category pioneer’ in India having a large gamer base and had more than 34.5% of market share for over seven years till Fiscal 2021. The company’s core competencies have been its investment in building its own in-house platforms and developing data intelligence capabilities. It believes that it offers a robust and seamless omni-channel digital offering, with fully integrated online play, through mobile, web and desktop versions, coupled with its offline capabilities.

Deltatech Gaming Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| TBA | 0 | 0 | 90 | 0 |

| TBA | 0 | 0 | 0 | 0 |

Deltatech Gaming IPO Financial Status

| Particulars (in Rs. Crores) | FY 22 (In Cr.) | FY 21 (In Cr.) | FY 20 (In Cr.) |

|---|---|---|---|

| Revenue from Operations | 137.23 | 155.37 | 131.65 |

| Profit After Tax | -4.40 | 15.95 | 29.85 |

| Expenses | 100.64 | 104.38 | 74.82 |

| Other Expenses | 100.64 | 104.38 | 74.82 |

| Other Income | 0.41 | 0.69 | 0.52 |

| EBITDA | 3.49 | 28.25 | 42.72 |

Deltatech Gaming IPO SWOT Analysis

Strengths

- Category pioneer with more than a decade of experience and market leadership by revenue.

- Demonstrated capabilities of building a real money gaming business with consistent positive operating cash flows and EBITDA.

- Strength of the ‘DELTIN’ brand and strong parentage of its Promoter, Delta Corp Limited, a leading company in the gaming industry in India.

- In-house technology and ability to leverage gamer data.

Risks

- Operations in skill-based fantasy and real money games are subject to regulatory uncertainty in India.

- Dependence on Adda52 makes it vulnerable to new entrants in the real-money gaming industry.

- Declining gamer base or engagement could harm liquidity, business, and financial performance.

- High gamer acquisition costs and low retention could harm business, revenue, and growth.

Frequently Asked Questions

What is the issue size of Deltatech Gaming IPO ?

The issue size is to be announced yet. |

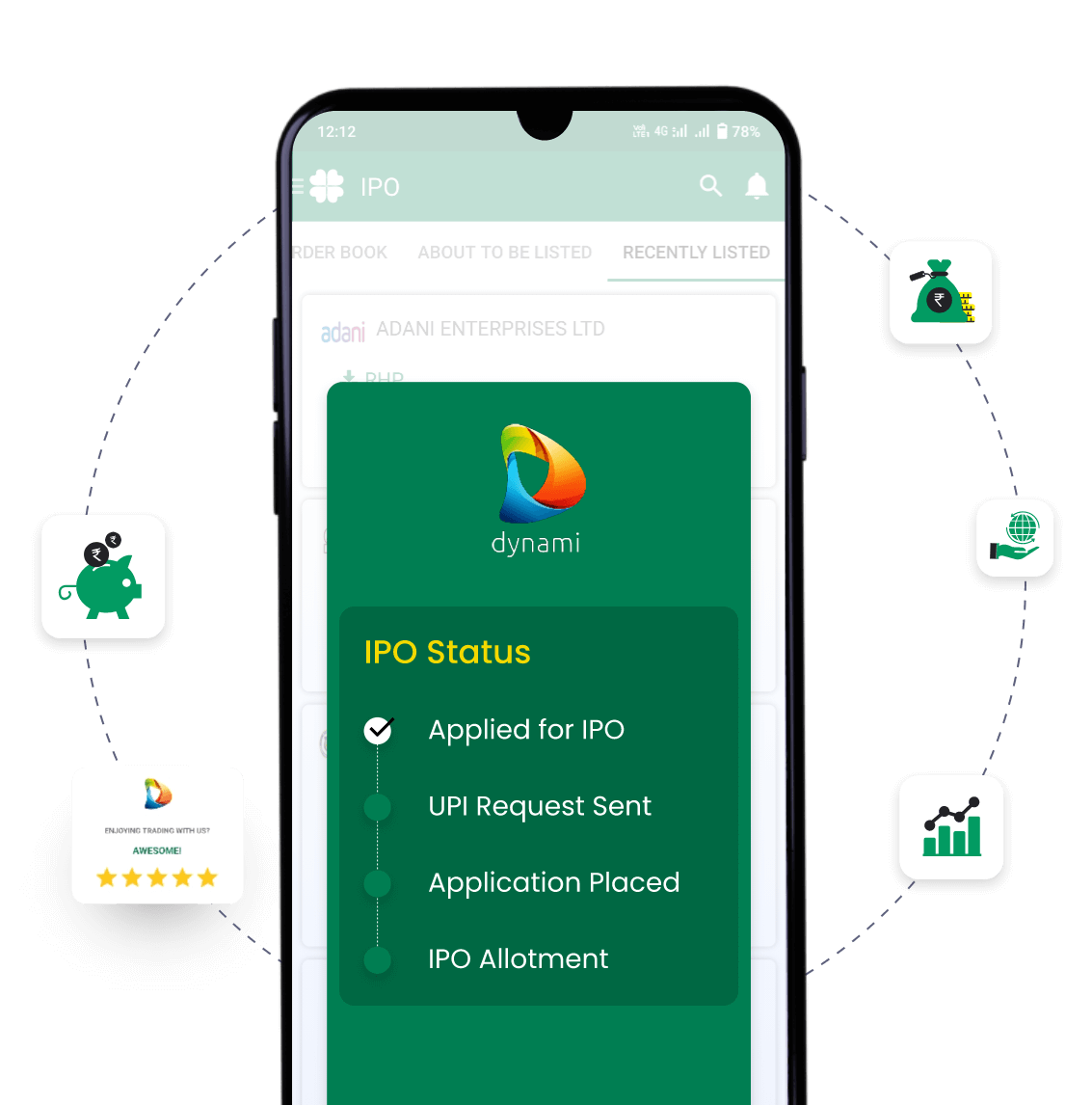

What is 'pre-apply' for Deltatech Gaming IPO?

| You can apply for the Deltatech Gaming IPO 2 days before the official subscription period begins using the pre-apply option. |

How can I pre-apply for Deltatech Gaming IPO?

| Pre-applying for the Deltatech Gaming IPO lets you apply before it officially opens. Click on the Apply Now link to apply for Deltatech Gaming IPO on Religare Broking. |

If I pre-apply for Deltatech Gaming IPO, when will my order get placed?

| Your order will be submitted to the exchange as soon as bidding for Deltatech Gaming IPO begins. You will receive a UPI request within 24 hours after the bidding starts. |

When will I know if my Deltatech Gaming IPO order is placed?

| We will notify you when your Deltatech Gaming order is placed with the exchange. |

What are the open and close dates of the Deltatech Gaming IPO?

| The open and close dates are yet to be announced. |

What is the lot size of the Deltatech Gaming IPO?

| The minimum lot size of the IPO is yet to be announced. |

What is the minimum order quantity and investment required for the Deltatech Gaming IPO?

| The minimum order quantity and investment required is yet to be announced. |

What is the price band of the Deltatech Gaming IPO?

| The price band of the IPO is yet to be announced. |

Upcoming IPOs Announced & Expected

Registrar information

Name

KFin Technologies Ltd

Phone number

+91 4067162222

Email ID

dgl.ipo@kfintech.com