About EbixCash IPO

EbixCash is a technology enabled provider of digital products and services in the B2C, B2B and financial technology arena through an integrated business model, with leadership positions in key businesses that it operates in. The company organizes its business along four primary business segments, (i) payment solutions, (ii) travel, (iii) financial technologies and (iv) business processing outsourcing services and start-up initiatives. It focuses on the convergence of financial exchange channels, processes and entities and is a comprehensive platform, where it aims to serve its customers’ needs, bringing together the advantages of B2B, B2C and B2B2C models within a single platform.

EbixCash IPO Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| TBA | 0 / 0 / 0 | 0 / 0 / 0 | 0 / 0 / 0 | 0 / 0 / 0 |

| TBA | 0 / 0 / 0 | 0 / 0 / 0 | 0 / 0 / 0 | 0 / 0 / 0 |

EbixCash IPO Financial Status

| Particulars (in Rs. Crores) | FY 21 (In Cr.) | FY 20 (In Cr.) | FY 19 (In Cr.) |

|---|---|---|---|

| Revenue | 4152.5 | 2170.0 | 1888.3 |

| EBITDA | 511 | 496.5 | 624.5 |

| PAT | 230.0 | 243.3 | 459.5 |

| Total Assets | 6793.7 | 6466.5 | 6552.8 |

| Share Capital | 0.2 | 0.2 | 0.2 |

| Total Borrowings | 1516.1 | 1520.4 | 1810.2 |

EbixCash IPO SWOT Analysis

Strengths

- Integrated business model offering a one-stop-shop for B2B, B2C, and B2B2C.

- Operating in regulated industries with a large network, resulting in a high barrier to entry.

- Multiple cross-selling opportunities, synergies, network effect, and wide reach for customer acquisition.

- Proprietary technology offering that is flexible and customizable for wide application across a variety of customer requirements.

Risks

- Company’s financial performance may suffer if it is unable to generate income from its fee and commission-based activities.

- Failure to maintain customer service quality or address complaints promptly could negatively impact business and results.

- Reliance on agents, franchisees, affiliates, and employees for distribution may be impacted by changes or adverse conditions, affecting operations and financial performance.

- Failure to obtain or maintain required permits and approvals could negatively impact business and financial performance.

Frequently Asked Questions

The issue size is to be announced yet.

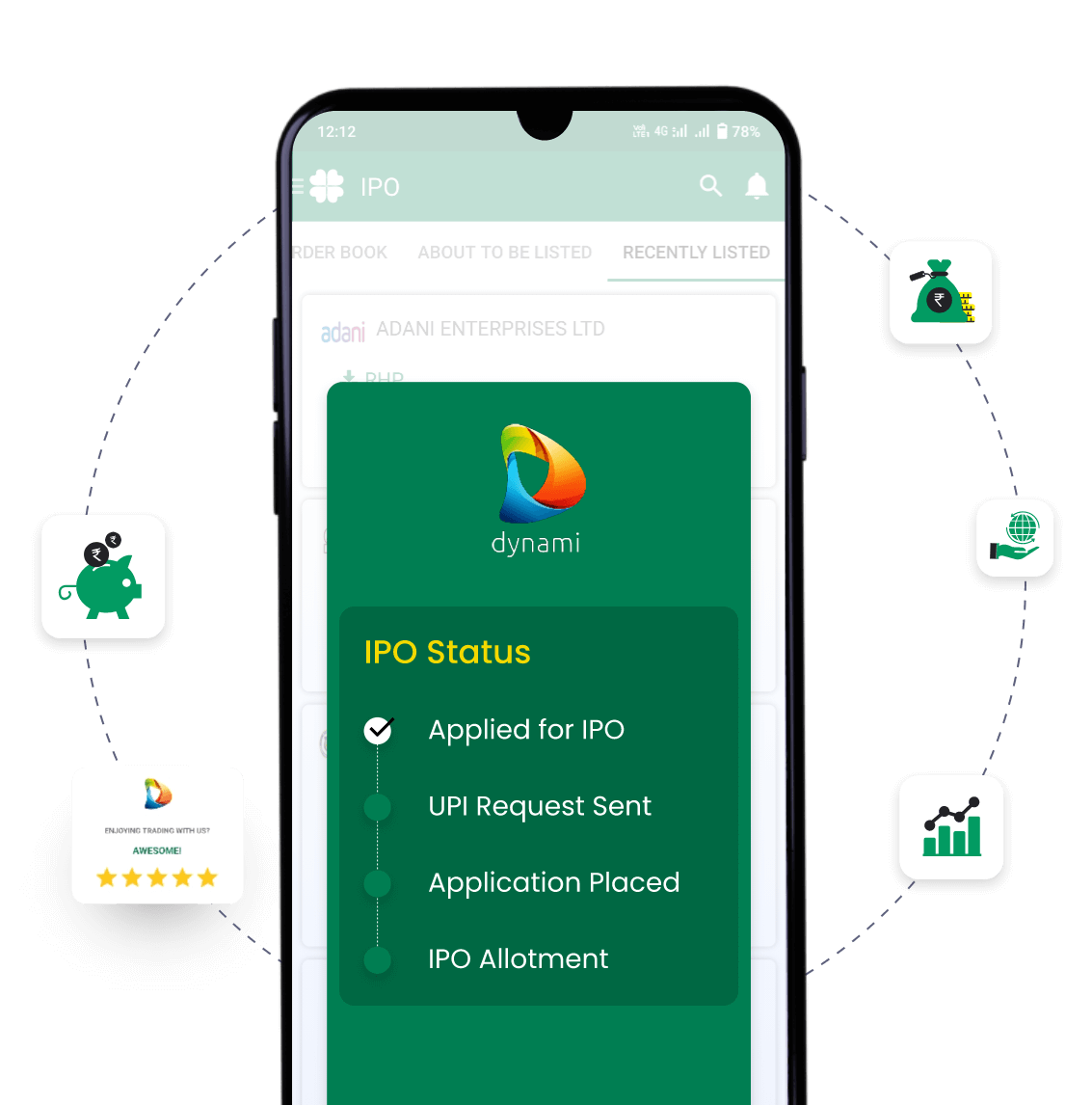

| You can apply for the EBIXCASH IPO 2 days before the official subscription period begins using the pre-apply option. |

| Pre-applying for the EBIXCASH IPO lets you apply before it officially opens. Click on the Apply Now link to apply for (IPO name) on Religare Broking. |

| Your order will be submitted to the exchange as soon as bidding for EBIXCASH IPO begins. You will receive a UPI request within 24 hours after the bidding starts. |

| We will notify you when your EBIXCASH IPO order is placed with the exchange. |

| The open and close dates are yet to be announced. |

| The minimum lot size of the IPO is yet to be announced. |

| The minimum order quantity and investment required is yet to be announced. |

| The price band of the IPO is yet to be announced. |

Upcoming IPOs Announced & Expected

Registrar information

Name

KFin Technologies Limited

Phone number

+91 22 4918 6200

Email ID

ebixcash.ipo@linkintime.co.in

EbixCash IPO

EbixCash IPO