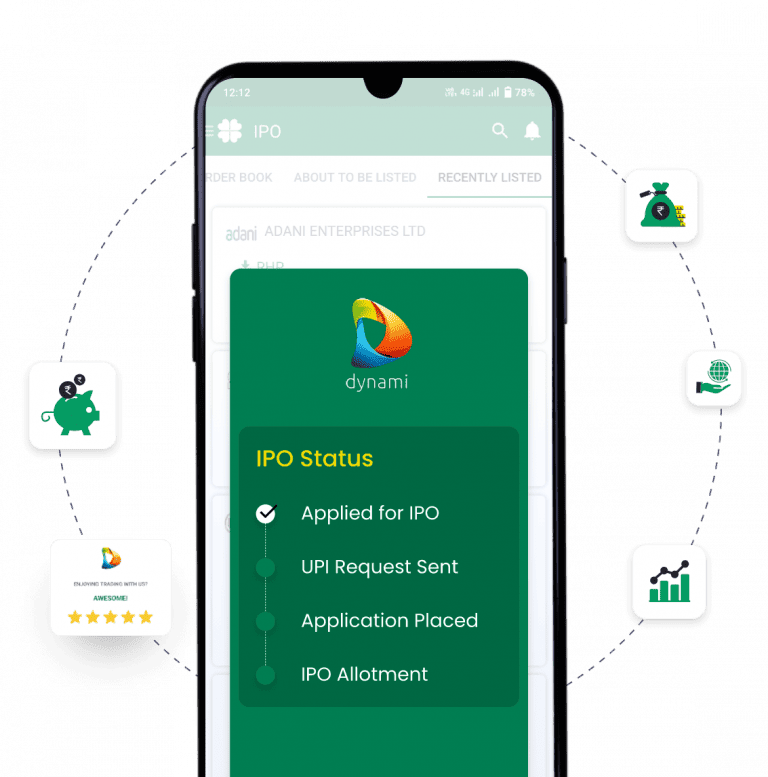

IPO Timeline

About ICICI Prudential Asset Management Company IPO

ICICI Prudential Asset Management Company (AMC), ICICI Bank, in collaboration with Prudential Plc, formed a joint venture company and is one of the largest asset management companies in India. It was founded in the year 1993 and provides a wide range of products such as mutual funds, ETFs, portfolio management services, and alternative investments. Through an extensive distribution network spanning banks, financial advisors, and digital platforms, ICICI AMC is catering to millions of retail and institutional investors. The firm uses its strong research and risk management framework to deliver good fund performance across market cycles. The forthcoming IPO offers investors exposure to India’s fast-growing asset management industry, while raising funds for digital expansion and product diversification. Therefore, with the increasing formalization of savings and growing awareness, ICICI Prudential AMC is well placed to sustain leadership across the Indian wealth management ecosystem.

ICICI Prudential Asset Management Company IPO Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| TBA | 0 | 0 | 0 | 0 |

| TBA | 0 | 0 | 0 | 0 |

ICICI Prudential Asset Management Company IPO Financial Status

| Particulars (in Rs. Crores) | 30 Sep 2025 | 31 Mar 2025 | 30 Sep 2024 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|---|

| Assets | 4,827.34 | 4,383.68 | 4,096.74 | 3,554.09 | 2,804.76 |

| Total Income | 2,949.61 | 4,979.67 | 2,458.23 | 3,761.21 | 2,838.18 |

| Profit After Tax | 1,617.74 | 2,650.66 | 1,327.11 | 2,049.73 | 1,515.78 |

| EBITDA | 2,210.10 | 3,636.99 | 1,837.55 | 2,780.01 | 2,072.58 |

| Net Worth | 3,921.56 | 3,516.94 | 3,272.28 | 2,882.84 | 2,313.06 |

| Reserves and Surplus | 3,903.91 | 3,432.85 | 3,254.63 | 2,798.75 | 2,228.97 |

ICICI Prudential Asset Management Company IPO SWOT Analysis

Strengths

- Being one of the largest asset managers in India, market leadership is a sure-shot way of creating brand trust.

- The desires of different investors are met by a greater variety of products offered in mutual funds, ETFs, and PMS.

- Good presence in terms of broad distribution makes them available across geographies.

- Equipped with strong risk management and research practices has translated into sustained good performances.

- Long-term growth prospects are supported by the increasing mobilization of savings in India.

Weaknesses

- Any downturns and upsurges in stock market performance directly impact streams of revenue.

- There is market share and competitive AMC pressure.

- There are binding regulatory constraints on fees, which are a hindrance to profitability.

- Rising adoption of passive funds poses a challenge to active fund demand.

- Over-dependence on retail inflows increases cyclicality risk.

Frequently Asked Questions

What is the issue size of ICICI Prudential Asset Management Company IPO?

The issue size for ICICI Prudential Asset Management Company IPO is ₹10602.65 Cr

What is 'pre-apply' for ICICI Prudential Asset Management Company IPO?

You can apply for the ICICI Prudential Asset Management Company IPO 2 days before the official subscription period begins using the pre-apply option. |

How can I pre-apply for ICICI Prudential Asset Management Company IPO?

Pre-applying for the ICICI Prudential Asset Management Company IPO lets you apply before it officially opens. Click on the Apply Now link to apply for ICICI Prudential Asset Management Company IPO on Religare Broking. |

If I pre-apply for ICICI Prudential Asset Management Company IPO, when will my order get placed?

Your order will be submitted to the exchange as soon as bidding for ICICI Prudential Asset Management Company IPO begins. You will receive a UPI request within 24 hours after the bidding starts. |

When will I know if my ICICI Prudential Asset Management Company IPO order is placed?

We will notify you when your ICICI Prudential Asset Management Company IPO order is placed with the exchange.

What are the open and close dates of the ICICI Prudential Asset Management Company IPO?

The open date is 12 Dec’2025 and the closing date is 16 Dec’2025

What is the lot size of the ICICI Prudential Asset Management Company IPO?

The lot size of the IPO is 6 shares

What is the price band of the ICICI Prudential Asset Management Company IPO?

The price band of the IPO is ₹2061 to ₹2165 per share |

Upcoming IPOs Announced & Expected

Rajputana Stainless IPO

Announced

Registrar information

Name

Kfin Technologies Ltd.

Phone number

04067162222, 04079611000

Email ID

icicipruamc.ipo@kfintech.com

ICICI Prudential Asset Management Company IPO

ICICI Prudential Asset Management Company IPO