Kalpataru Ltd IPO

Kalpataru is an integrated real estate development company involved in all key activities associated with real estate development, including the identification and acquisition of land (or development rights thereto), planning, designing, execution, sales, and marketing of its projects. It is a prominent real estate developer in the Mumbai Metropolitan Region in Maharashtra and is present across all micro-markets in the MMR. For the calendar years 2019 to 2023, the MMR was ranked first among the top seven Indian markets. It is the fifth largest developer in the MCGM area in Maharashtra and the fourth largest developer in Thane, Maharashtra in terms of units supplied from the calendar years 2019 to 2023. The company believes that the strength of the “Kalpataru” brand and its association with trust, quality, and reliability is driven by its track record of delivering quality projects largely within committed timelines.

Kalpataru Ltd IPO Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| TBA | 0 / 0 / 0 | 0 / 0 / 0 | 0 / 0 / 0 | 0 / 0 / 0 |

| TBA | 0 / 0 / 0 | 0 / 0 / 0 | 0 / 0 / 0 | 0 / 0 / 0 |

Kalpataru Ltd IPO Financial Status

| Particulars (in Rs. Crores) | FY 24 (In Cr.) | FY 23 (In Cr.) | FY 12 (In Cr.) |

|---|---|---|---|

| Revenue | 1929.99 | 3633.19 | 1000.68 |

| EBITDA | 78.02 | 49.67 | 35.98 |

| Profit/Loss | 113.81 | 226.79 | 121.55 |

| Total Assets | 10267.53 | 9371.91 | 7320.86 |

| Total Borrowings | 10688.31 | 9679.65 | 10365.97 |

| EPS | 7.21 | 14.37 | 8.65 |

Kalpataru Ltd IPO SWOT Analysis

Strengths

- Prominent real-estate company in the Mumbai Metropolitan Region in Maharashtra with a portfolio of projects diversified across different micro-markets and price points in the Mumbai Metropolitan Region and Pune, Maharashtra.

- Well-established brand with the ability to sell throughout the construction phase.

- Strong project pipeline with visibility towards near-term cash flows.

- Proven end-to-end execution capabilities with continuous innovation and ability to deliver projects in a timely fashion.

Risks

- The company faces risks related to land acquisition due to limited supply, increased competition, and regulations, which may impact its business and financial performance.

- Delays and cost overruns in ongoing, forthcoming, and planned projects could negatively impact business and financial performance.

- Failure to acquire all necessary land for two planned projects may prevent their development as planned or at all.

- The company’s commercial and retail real estate businesses depend on providing quality space, forecasting demand, and securing leasing arrangements; failure to do so may impact operations and cash flow.

Frequently Asked Questions

| The issue size is to be announced yet. |

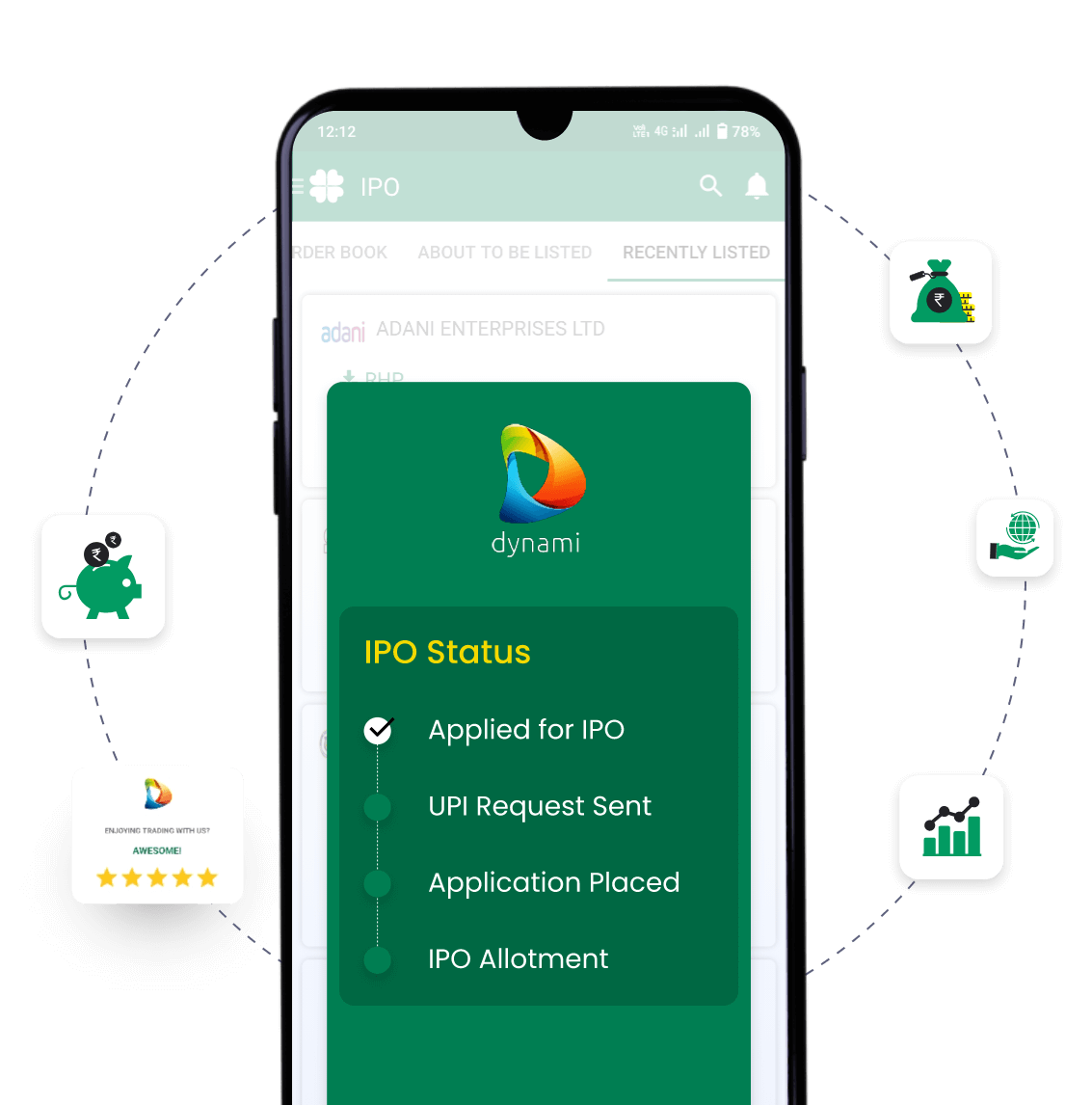

| You can apply for the Kalpataru Ltd IPO 2 days before the official subscription period begins using the pre-apply option. |

| Pre-applying for the Kalpataru Ltd IPO lets you apply before it officially opens. Click on the Apply Now link to apply for (IPO name) on Religare Broking. |

| Your order will be submitted to the exchange as soon as bidding for Kalpataru Ltd IPO begins. You will receive a UPI request within 24 hours after the bidding starts. |

| We will notify you when your Kalpataru Ltd IPO order is placed with the exchange. |

| The open and close dates are yet to be announced. |

| The minimum lot size of the IPO is yet to be announced. |

| The minimum order quantity and investment required is yet to be announced. |

| The price band of the IPO is yet to be announced. |

Upcoming IPOs Announced & Expected

Bharat coking coal ipo

Announced

Name

Link Intime India Private Limited

Phone number

+91 22 4918 6200

Email ID

kalpataru.ipo@linkintime.co.in