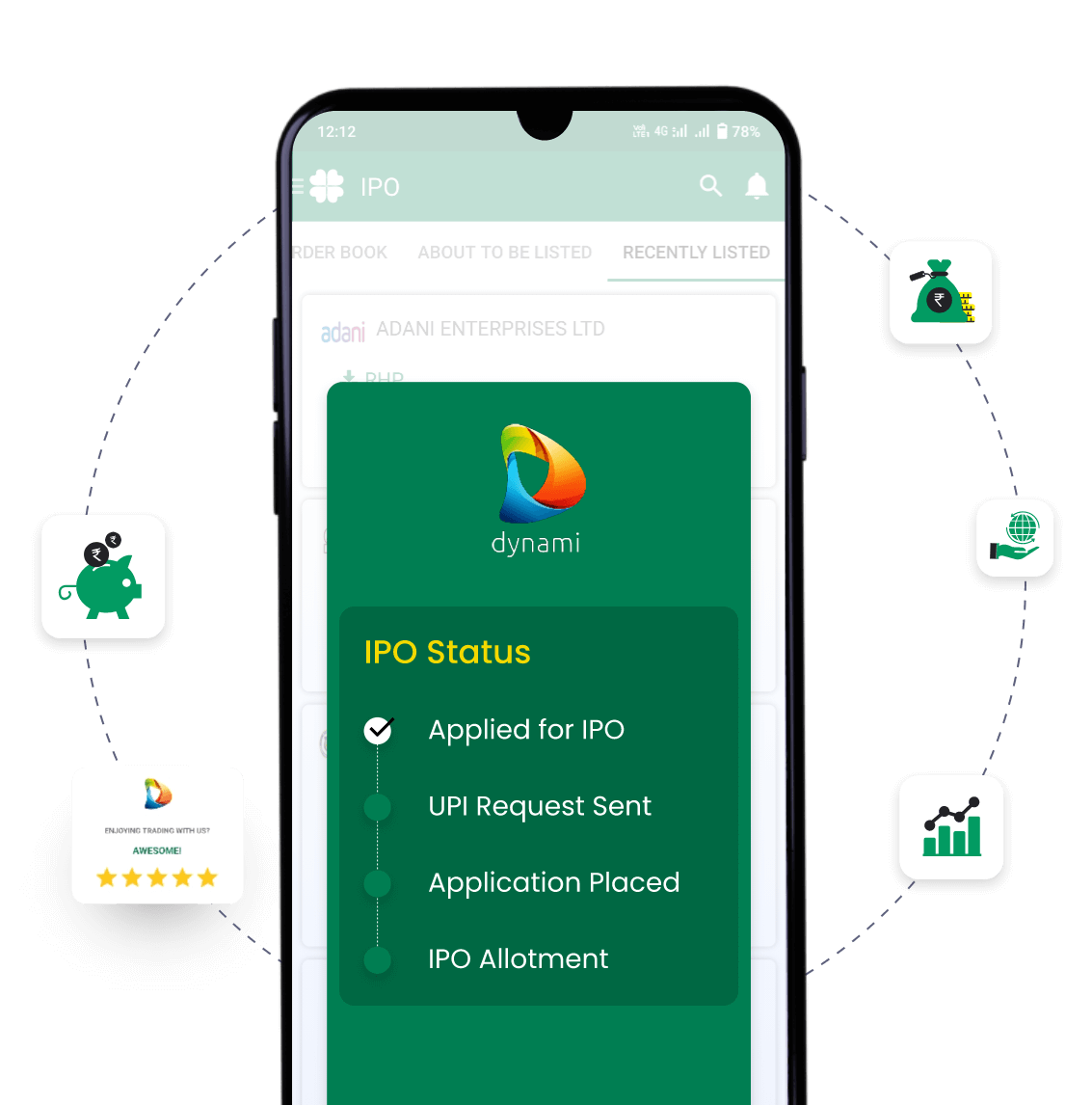

IPO Timeline

About Kumar Arch Tech IPO

Kumar Arch Tech is the largest manufacturer and exporter of PVC blend-based building material products in India, in terms of value, as of March 31, 2024. With a legacy of over 22 years of operations, the company’s expertise in material science and its R&D capabilities, it has developed its proprietary formulations which give it the flexibility to manufacture products by blending more than eight different raw materials. The company provides its customers a wide range of products, classified into three categories, (i) board/sheets and their derivatives such as trimboards, doors, and wall ceiling panels and columns, (ii) profiles which comprise of mouldings and door frames, (iii) and signage solutions. It is one of the pioneers in the PVC blend-based building material products industry in India, having diversified its product offering along with innovation and quality well suited to meet the requirements of international and Indian markets. It commanded 18% market share in the PVC blend-based building material products industry in India as of March 31, 2024.

Kumar Arch Tech IPO Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| TBA | 0 | 0 | 0 | 0 |

| TBA | 0 | 0 | 0 | 0 |

Kumar Arch Tech IPO Financial Status

| Particulars (in Rs. Crores) | FY 24 (In Cr.) | FY 23 (In Cr.) | FY 12 (In Cr.) |

|---|---|---|---|

| Revenue | 407.88 | 407.26 | 250.57 |

| PAT | 110.78 | 63.01 | 20.43 |

| Net Worth | 228.35 | 117.38 | 53.79 |

| Total Borrowings | 30.07 | 29.4 | 29.61 |

| EPS | 6.45 | 3.67 | 1.19 |

| ROE | 64.10% | 73.62% | 46.93% |

Kumar Arch Tech IPO SWOT Analysis

Strengths

- Largest manufacturer and exporter of PVC blend-based building material products and an emerging domestic player in a majorly unorganised Indian market, well-positioned to capture industry tailwinds.

- Robust and diversified product portfolio supported by innovation capabilities and an understanding of material science.

- Established credentials in developed markets with repeat business from large-scale customers.

- Scaled-up infrastructure with a skilled workforce delivering consistently and efficiently, providing promised quality products to customers on time.

Risks

- Business relies on customer relationships, and losing key customers or facing reduced demand could negatively impact operations and financials.

- Relying on imported raw materials without long-term supplier agreements exposes the company to risks in cost, availability, and quality, impacting business and cash flows.

- Disruptions in manufacturing operations could significantly impact business, financial condition, and cash flows.

- Failure to grow in existing or new export markets could negatively impact business, cash flows, and financial performance.

Frequently Asked Questions

The issue size is to be announced yet.

You can apply for the Kumar Arch Tech IPO 2 days before the official subscription period begins using the pre-apply option.

Pre-applying for the Kumar Arch Tech IPO lets you apply before it officially opens. Click on the Apply Now link to apply for (IPO name) on Religare Broking.

Your order will be submitted to the exchange as soon as bidding for PayMate India Ltd IPO begins. You will receive a UPI request within 24 hours after the bidding starts.

The open and close dates are yet to be announced.

The minimum order quantity and investment required is yet to be announced.

The price band of the IPO is yet to be announced.

Upcoming IPOs Announced & Expected

Rajputana Stainless IPO

Announced

Registrar information

Name

KFin Technologies Limited

Phone number

+91 40 6716 2222

Email ID

echon.ipo@kfintech.com

Kumar Arch Tech IPO

Kumar Arch Tech IPO