IPO Timeline

About Manjushree Technopack IPO

Manjushree Technopack is the largest rigid plastic packaging (RPP) player in terms of installed capacity in India as of March 31, 2024 operating in the consumer rigid plastics industry, according to the Technopak Report. It is a one-stop packaging solutions provider with end-to-end capabilities (i.e., from design to delivery) across containers, preforms, caps and closures, pumps and dispensers and captive recycling capabilities. It is a derivative of the consumer industry given its presence across a wide range of end industries including food and beverages, home care, personal care, alco-beverage, paints and adhesives, pharmaceuticals, nutraceuticals, dairy and agrochemicals.

Manjushree Technopack IPO Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| TBA | 0 | 0 | 90 | 0 |

| TBA | 0 | 0 | 0 | 0 |

Manjushree Technopack IPO Financial Status

| Particulars (in Rs. Crores) | FY 23 (In Cr.) | FY 22 (In Cr.) | FY 21 (In Cr.) |

|---|---|---|---|

| Revenue | 2117.01 | 2096.34 | 1467.05 |

| PAT | 140.8 | 59.24 | 70.82 |

| Net Worth | 1008.15 | 951.01 | 900.74 |

| Total Borrowings | 246.62 | 243.38 | 291.26 |

| ROE | 14.37% | 6.40% | 9.76% |

| EBITDA | 382.87 | 301.14 | 241.32 |

Manjushree Technopack IPO SWOT Analysis

Strengths

- Only player of this scale in India with market leadership in the consumer rigid plastics packaging industry across product categories.

- Derivative of the consumer industry with a diversified business model that sustains market leadership and enables it to serve as a one-stop-shop solutions provider.

- The Indian RPP industry has a large total addressable market (TAM), is fragmented and is estimated to continue shifting from unorganized to organized.

- Trusted partner of choice for a marquee customer base across global, regional, and national brands with a customer-centric approach.

Risks

- A slowdown in demand for containers and preforms could materially impact business, financial condition, cash flows, and operations.

- Disruptions or shutdowns of its manufacturing facilities could materially affect business, financial condition, cash flows, and operations.

- Lack of long-term customer agreements and failure to secure regular orders could impact business.

- Strategic acquisitions or investments may be difficult to integrate or may not succeed.

Frequently Asked Questions

The issue size is to be announced yet.

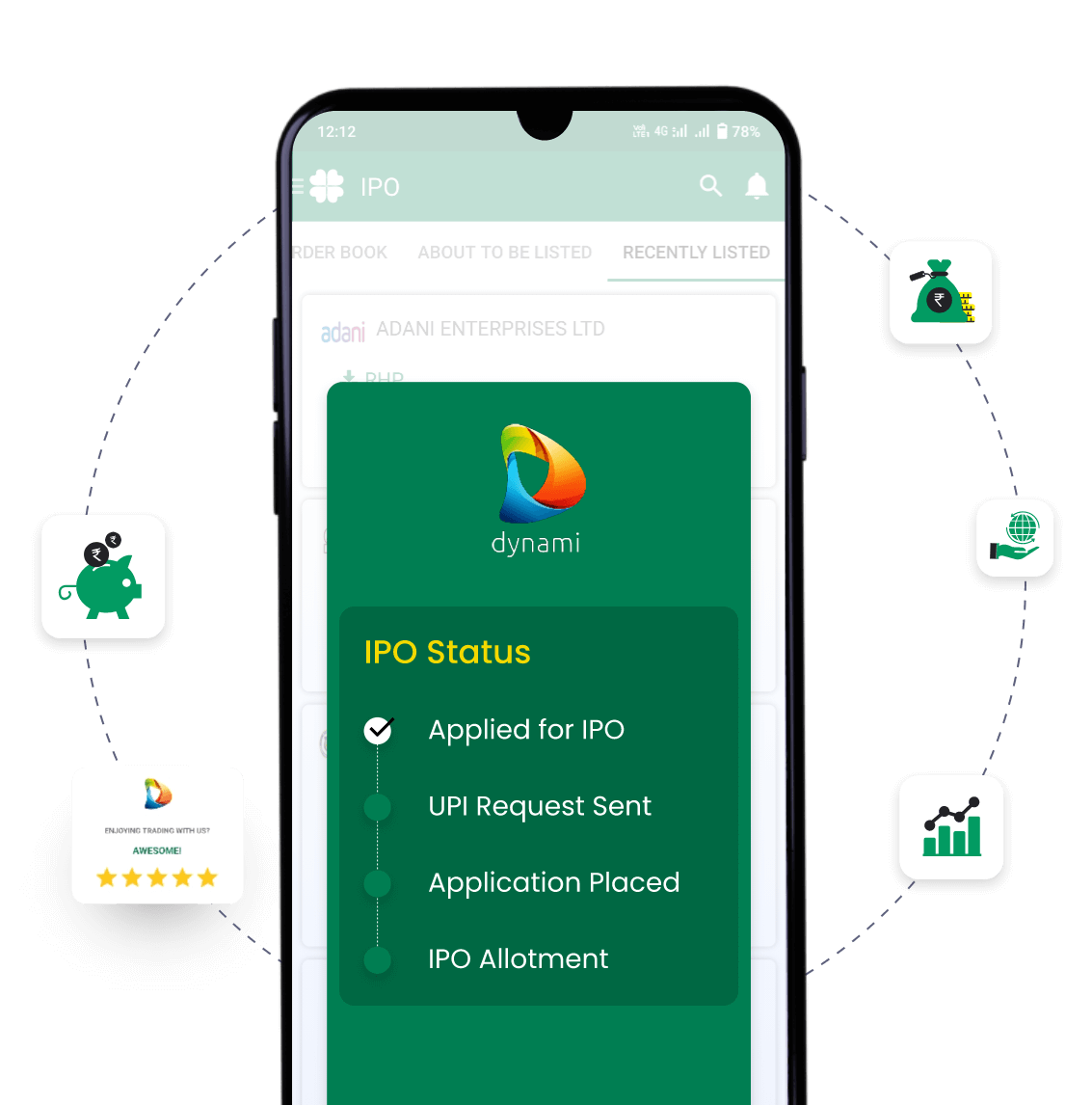

You can apply for the Manjushree Technopack IPO 2 days before the official subscription period begins using the pre-apply option.

Pre-applying for the Manjushree Technopack IPO lets you apply before it officially opens. Click on the Apply Now link to apply for (IPO name) on Religare Broking.

Your order will be submitted to the exchange as soon as bidding for Manjushree Technopack IPO begins. You will receive a UPI request within 24 hours after the bidding starts. Broking.

We will notify you when your Onset Ltd IPO order is placed with the exchange.

The open and close dates are yet to be announced.

The minimum lot size of the IPO is yet to be announced.

The minimum order quantity and investment required is yet to be announced.

The price band of the IPO is yet to be announced.

Upcoming IPOs Announced & Expected

Rajputana Stainless IPO

Announced

Registrar information

Name

KFin Technologies Limited

Phone number

+91 40 6716 2222/ 18003094001

Email ID

einward.ris@kfintech.com