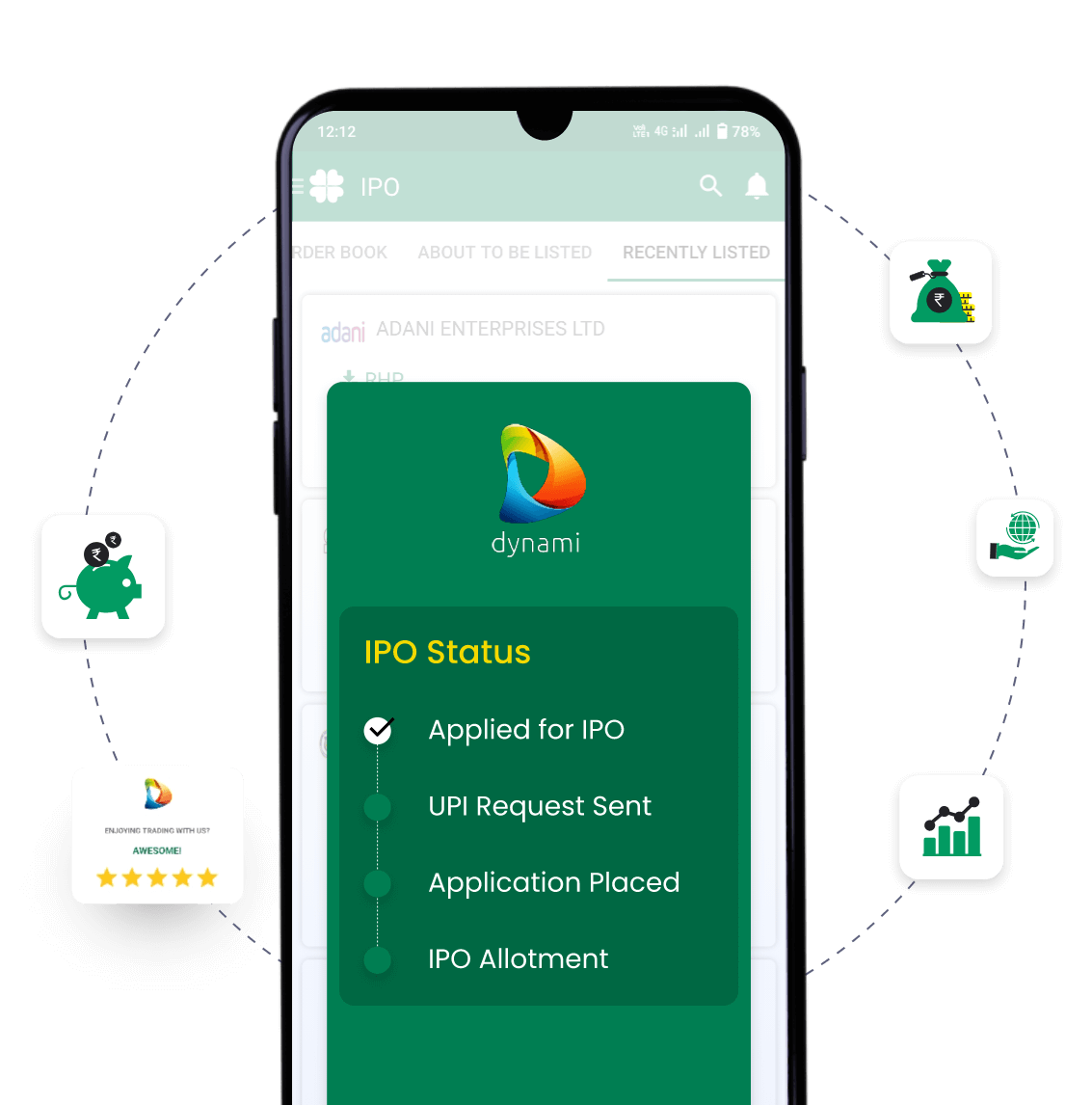

IPO Timeline

About Mayasheel Ventures Limited IPO

Mayasheel Ventures Limited, formerly operating as Mayasheel Construction (a partnership firm since 2008), is a civil infrastructure company headquartered in Ghaziabad, Uttar Pradesh. It was converted into a public limited company in May 2024. The company specialises in constructing roads and highways, and executing EPC (Engineering, Procurement, and Construction) contracts, primarily for government clients across North and East India. MVL’s service offerings include earthwork, asphalt laying, culvert construction, and road widening projects. It has a track record of executing both new projects and maintenance contracts, with key clients including NHAI and various state PWD departments. The company proposes to raise capital through an IPO of up to 58,05,000 equity shares to strengthen working capital, repay debt, and provide financial flexibility for upcoming government tenders.

Mayasheel Ventures Limited IPO Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| 20-Jun-25 | 0.00 | 0.02 | 0.07 | 0.04 |

| TBA | 0 | 0 | 0 | 0 |

Mayasheel Ventures Limited IPO Financial Status

| Particulars (in Rs. Crores) | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|

| Assets | 99.10 | 92.56 | 79.03 |

| Revenue | 172.05 | 131.14 | 127.10 |

| Profit After Tax | 11.33 | 6.51 | 4.75 |

| Net Worth | 28.84 | 24.09 | 18.06 |

| Reserves and Surplus | 12.59 | 0.00 | 0.00 |

| Total Borrowing | 34.06 | 35.05 | 33.23 |

Mayasheel Ventures Limited IPO SWOT Analysis

Strengths

- Well-established Government Projects: Experienced in carrying out major road and highway works for the state and centre-level agencies through the EPC model.

- Active Execution across Two Regions: A strong pipeline of work and several current contracts are being carried out in Uttar Pradesh and Assam.

- Seasoned Promoters: With more than 15 years of experience in road construction, the promoters ensure that decisions are made properly and that projects are finished as scheduled.

- Project Qualification Credentials: Accredited with working on major tenders, resulting in consistent orders from public works departments.

Risks

- High Debt-to-Equity Ratio: As of June 2024, D/E stood at 3.19:1, reflecting significant reliance on borrowed funds and potential stress on liquidity during downturns.

- Loan & Asset Name Mismatch: Outstanding loans and insurance policies still reflect the previous entity name (“Mayasheel Construction”), posing legal and compliance risks.

- Raw Material Dependency: The majority, or 80%, of the company's raw materials were from Assam and West Bengal during the past year, making it vulnerable if supply stops.

- Bank Guarantee Obligations: Contingent liabilities of ₹2,936.86 lakh related to performance guarantees may strain cash flows if invoked due to project delays or disputes.

Frequently Asked Questions

What is 'pre-apply' for Mayasheel Ventures Limited IPO?

You can apply for the Mayasheel Ventures Limited IPO 2 days before the official subscription period begins using the pre-apply option. |

If I pre-apply for Mayasheel Ventures Limited IPO, when will my order get placed?

Your order will be submitted to the exchange as soon as bidding for Mayasheel Ventures Limited IPO begins. You will receive a UPI request within 24 hours after the bidding starts. |

What is the lot size of theMayasheel Ventures Limited IPO?

| The lot size of the IPO is 3000 shares. |

What is the price band of the Mayasheel Ventures Limited IPO?

| The price band of the IPO is ₹44 to ₹47 per share . |

Upcoming IPOs Announced & Expected

Registrar information

Name

Maashitla Securities Private Limited

Phone number

11-45121795-96

Email ID

ipo@maashitla.com

Mayasheel Ventures Limited IPO

Mayasheel Ventures Limited IPO