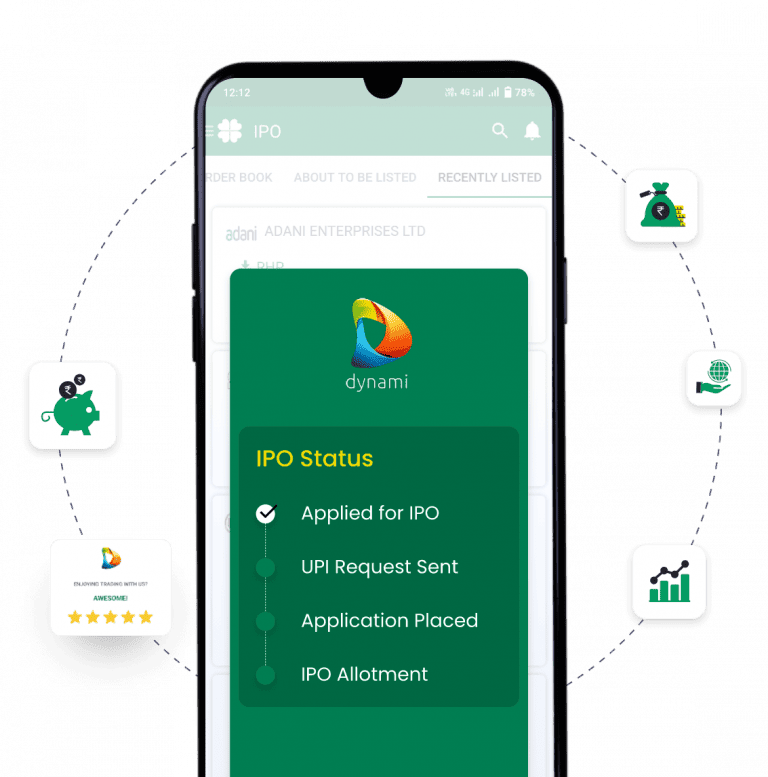

IPO Timeline

About Meesho IPO

Meesho, founded in 2015, is a social commerce platform allowing individuals and businesses to sell goods online through social channels like WhatsApp and Facebook. The company hence gives resellers access to product catalogs, logistics, and payment solutions, among others, democratizing e-commerce in India. They largely penetrate Tier-2 and Tier-3 cities through cheap goods and micro-entrepreneurship opportunities, especially for women. It spans fashion, lifestyle, home, and electronics, serving consumers with the cheapest demands. The company is only continuing to expand its user and seller base with the help of marquee investors. Proceeds from the IPO are meant for expansion, supply chain strengthening, and technology investment. As small towns continue to grow in terms of social commerce and digitalisation, Meesho stands a prime chance to make a mark in closing the divide in e-commerce penetration in India.

Meesho IPO Subscription Status

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| TBA | 0 | 0 | 0 | 0 |

| TBA | 0 | 0 | 0 | 0 |

Meesho IPO Financial Status

| Period Ended | 30 Sep 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Assets | 6,640.3 | 7,226.0 | 4,160.9 | 3,853.35 |

| Total Income | 5,857.69 | 9,900.90 | 7,859.24 | 5,897.6 |

| Profit After Tax | -700.7 | -3,941.7 | -327.64 | -1,671.90 |

| Net Worth | -551.8 | -219.59 | -230.15 | -1,693.73 |

| Reserves and Surplus | 968.8 | 1,561.8 | 2,301.6 | 2,548.31 |

| Total Borrowing | 0 | 0 | 0 | 0 |

Meesho IPO SWOT Analysis

Strengths

- A firm presence in Tier-2 and Tier-3 towns assists in creating a feeling of trust between the underserved consumers.

- Social commerce reduces the cost of acquisition and creates virality through networks.

- The women and micro-entrepreneurs who will be empowered will enhance the brand validation and also introduce community loyalty.

- Low price ensures high appeal for India's price-conscious consumer segment.

- Strong investor connection brings about the strength of growth and developmental strategies.

Weaknesses

- Revenue generation emphasizing low-price products results in low margins and profitability issues.

- The heavier reliance on a logistics partner puts potential fulfillment issues.

- Heavy competition from Flipkart, Amazon, and Reliance JioMart.

- The retention and trust of customers raise questions about the product's quality.

- Revenue is generally highly dependent on unorganized sellers' moving to scale.

Frequently Asked Questions

What is the issue size of Meesho Ltd. IPO?

The issue size for Meesho Ltd. IPO is ₹5,421.20 Cr

What is 'pre-apply' for Meesho Ltd. IPO?

You can apply for the Meesho Ltd. IPO 2 days before the official subscription period begins using the pre-apply option.

How can I pre-apply for Meesho Ltd. IPO?

Pre-applying for the Meesho Ltd. IPO lets you apply before it officially opens. Click on the Apply Now link to apply for Meesho Ltd. IPO

on Religare Broking.

If I pre-apply for Meesho Ltd. IPO , when will my order get placed?

Your order will be submitted to the exchange as soon as bidding for Meesho Ltd. IPO

begins. You will receive a UPI request within 24 hours after the bidding starts.

When will I know if my Meesho Ltd. IPO order is placed?

We will notify you when your Meesho Ltd. IPO

. order is placed with the exchange.

What are the open and close dates of the Meesho Ltd. IPO?

The open date is Dec 3, 2025 and the closing date is Dec 5, 2025

What is the lot size of the Meesho Ltd. IPO?

The lot size of the IPO is 135 Shares

What is the price band of the Meesho Ltd. IPO?

The price band of the IPO is ₹105 to ₹111 per share

Upcoming IPOs Announced & Expected

Registrar information

Name

Kfin Technologies Ltd.

Phone number

04067162222, 04079611000

Email ID

meesho.ipo@kfintech.com

Meesho IPO

Meesho IPO