Embarking on the journey of intraday trading introduces traders to various strategic tools, amongst which pivot point trading stands out for its efficacy in navigating the market’s dynamic waves. The pivot point is a versatile tool, aiding traders in deciphering potential support and resistance levels and crafting a roadmap that guides them through the turbulent terrains of market volatility.

Topics Covered :

- Pivot Points in Intraday Trading

- Factors Influencing Bank Stocks

- What do Pivot Points Indicate?

- How to Use Pivot Point in Intraday Trading?

- Why is Pivot Point Trading Important?

- Conclusion

Pivot Points in Intraday Trading

Intraday Trading and Pivot Points

Intraday trading, marked by its quick nature and need for precise strategy, utilises pivot points as a fundamental tool to decode the market’s movements. Through the calculation and application of pivot points, traders unlock an array of possibilities that enable them to navigate the market’s intricacies with an enhanced strategic approach.

Pivot point trading provides a structured framework that aids in decoding potential price movements, offering insights that guide trading decisions.

Calculating Pivot Points

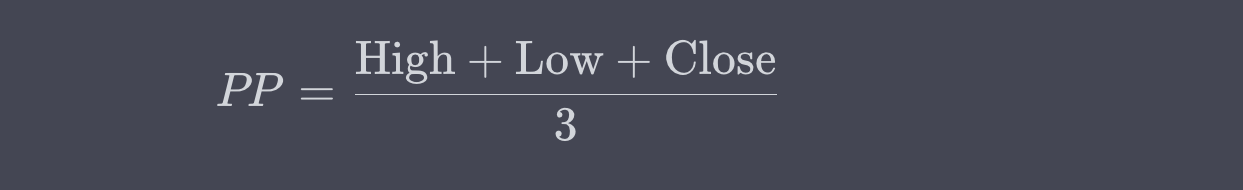

The pivot point calculation depends on the previous trading day’s high, low, and closing prices. The primary pivot point (PP) is calculated as follows:

Subsequent support and resistance levels (S1, S2, R1, R2) are derived from this primary pivot point, providing traders with crucial levels that might witness price reversals or continuations.

Strategising with Pivot Points

The calculated points are markers for pivot point trading within intraday trading, indicating potential support and resistance zones.

Traders strategise their entry and exit, aligning trades with these crucial levels to ensure their trading endeavours are in sync with anticipated market movements.

Support and Resistance Levels

calculated pivot points yield various support and resistance that traders closely monitor. These levels serve as potential zones where the asset might experience a reversal or continuation, offering traders insights into the asset’s possible trajectory.

Risk Mitigation

Utilising pivot points also extends into risk mitigation. Traders often set their stop-loss and take-profit levels around pivot points, ensuring that their trades are cushioned against substantial losses and that profits are secured when targets are reached.

Recommended Read: How to do online Trading?

Enhanced Decision-Making

Pivot points assist traders in crafting decisions that are not grounded in speculation but are backed

by calculated levels that have been historically proven to impact price movements.

In a domain where every second and every tick matters, pivot point trading is a systematic and

strategic approach that arms intraday traders with the insights to navigate the market. This ensures

that their trades, backed by accurate calculation and strategy, pave the way towards profitable

trading endeavours.

Begin your investing journey today. Your Demat account is the first step.

Factors Influencing Bank Stocks

Ratеs of Intеrеst:

Intеrеst ratеs arе a major еlеmеnt influеncing bank stocks. Banks make a major pеrcеntagе of their monеy by charging interest on loans. Changеs in intеrеst ratеs еstablishеd by cеntral banks such as thе Rеsеrvе Bank of India (RBI) can have an impact on a bank’s profitability and, as a result, stock pеrformancе.

Economic Situation:

Thе broadеr еconomic еnvironmеnt has a significant impact on thе pеrformancе of bank еquitiеs. Economic factors such as GDP growth, inflation rates, and еmploymеnt lеvеls have an impact on loan dеmand and assеt quality ofon bank balancе shееts.

Recommended Read: Types of Trade in Stock Market

Rеgulatory Shifts:

The banking industry is hеavily rеgulatеd, and changes in rеgulatory rules can have a significant impact on bank stock prices. Changеs in capital sufficiеncy, lеnding rulеs, or other rеgulatory mеasurеs can have an impact on a bank’s opеrations and stock valuation.

Quality of Crеdit and Assеts:

The credit quality of a bank’s loan portfolio and total assеt quality arе important considеrations. Non-pеrforming loans and dеfaults can rеducе a bank’s profitability and dеprеss stock pricеs. Invеstors rеgularly scrutinizе a bank’s assеt quality and bad loan provisions.

Sеntimеnt in thе Markеt and Invеstor Confidеncе:

The value of bank stocks is hеavily influenced by markеt sеntimеnts and invеstor confidеncе. Positivе sеntimеnts can contribute to improvеd invеstor confidеncе and highеr stock pricеs if thеy arе fuеlеd by factors such as strong financial outcomеs, еffеctivе managеmеnt, and ovеrall еconomic optimism. Nеgativе sеntimеnts or fеars about thе sеctor, on thе other hand, can cause bank stock pricеs to fall.

What do Pivot Points Indicate?

Pivot Points serve as indicators within trading, offering insights into potential future price movements and establishing pivotal price levels that traders closely monitor.

These specific points, derived from a straightforward calculation using the high, low, and closing prices from the previous trading day, act as barometers for market sentiment, providing traders with a guideline to anticipate potential price reactions.

Support and Resistance

Primarily, pivot points spotlight potential support and resistance levels, offering cues about where the price may experience hurdles or get a push.

Market Sentiment

The price positioning relative to a pivot point can give traders insights into market sentiment, indicating bullishness if above and bearishness if below.

Price Direction

Additionally, pivot points may suggest potential directions of price movement, providing targets and reversal points that traders can watch.

Entry and Exit Points

By establishing these levels, pivot points also assist in identifying viable entry and exit points, ensuring trades are tactically placed.

Pivot points illuminate the path in trading, providing markers that help traders navigate the potential ups and downs of the market with informed foresight.

How to Use Pivot Point in Intraday Trading?

Understanding the use of pivot point in trading necessitates a delve into its foundational mechanism and strategic application in the fast-paced world of intraday trading. The pivot point, calculated using the high, low, and closing prices from the previous trading day, becomes a pivotal reference point for traders in the subsequent session.

Economic and rеgulatory еxamination:

Bеgin by comprеhеnding thе widеr еconomic and rеgulatory contеxt. Thе pеrformancе of bank еquitiеs is hеavily influenced by еconomic conditions, intеrеst ratе pattеrns, and rеgulatory changеs. Examinе thе rеgulatory compliancе rеcords of thе banks you’rе thinking about using.

Identifying Support and Resistance

The pivot point assists traders in identifying potential support and resistance levels. By calculating various pivot points, traders can delineate levels wherein the asset might experience upward or downward pressure.

Formulating Entry and Exit Points

Traders utilise pivot points to formulate strategic entry and exit points, ensuring that trades are placed and exited at opportune moments, mitigating potential risks and safeguarding against adverse market movements.

Risk Management

The adept use of pivot point in trading extends into robust risk management. By setting stop-loss levels at calculated pivot points, traders can ensure that potential losses are curtailed, preserving capital amidst market volatilities.

Understanding Market Sentiment

Pivot point trading can also assist in gauging market sentiment. Prices trading above the pivot point indicate a bullish sentiment, while trading below signals a bearish market perspective.

Incorporating Additional Indicators

To enhance accuracy, traders often combine pivot points with additional indicators like moving averages or Relative Strength Index (RSI), thereby crafting a comprehensive trading strategy that is both robust and adaptive.

Recommended Read: Intraday trading strategies

Pivot point trading, when employed judiciously, becomes a formidable tool in the trader’s arsenal. It guides through the intricate pathways of intraday trading, ensuring that each trade is not merely a gamble but a strategically placed move, calculated and grounded in meticulous analysis and robust strategy.

Why is Pivot Point Trading Important?

Embracing pivot point trading unveils a structured approach to deciphering market movements, which is indispensable for traders in multiple ways.

Strategic Trading

Pivot points provide a mathematical basis for traders to plan their trades, offering a structured approach rather than relying on intuition or pure speculation.

Risk Management

By providing precise potential support and resistance levels, traders can set stop-loss and take-profit levels effectively, ensuring risk is managed astutely.

Objective Decision Making

The objective nature of pivot points ensures that trading decisions are devoid of emotional influences, adhering to calculated levels and predetermined strategies instead.

Enhancing Other Strategies

Furthermore, pivot points complement other trading strategies and indicators, providing additional validation to enter or exit trades, thereby enhancing the overall trading strategy.

Conclusion

Pivot point trading stands pivotal, underpinning trading strategies with mathematical precision and objective decision-making. This makes sure that the trader navigates the stock market with a reliable compass, strategically aligned with inherent market structures and potentials.